In an effort to save Michigan residents money the state legislator is considering changes to the no fault insurance which would allow Michigan drivers the option to choose a lower cost, lower coverage insurance and save around 15% off of their premiums.

Unfortunately this is another case of the legislator favoring the will of big business over the good of the people.

First, it should be pointed out that this bill is yet another bill that would have a tiny "implementation" budget attached to the bill making it referendum proof. This forces Michigan residents to take extreme measures to repeal this bill if they don't like it. This is clear government overreach as the legislator limits some of the democratic rights of the people.

Second, this bill "fixes" the symptom not the problem. The reason car insurance costs are increasing has nothing to do with car insurance. It has everything to do with the cost of health care. As health care costs rise so does every form of insurance that covers you in the event of an accident. If you want to have a meaningful impact on car insurance rates you have to fix the problems with the costs of health care.

Additionally, in the end, this bill will not save Michigan residents money. What this will do is force many people to pay for their own health care costs associated with a car accident. Those who cannot pay will either go bankrupt or be put on the tax payer funded medicare system. This puts Michigan residents in the position of paying a little more now or even more later. The only savings here is for the insurance industry which is why they are fighting so hard for this bill.

Lastly, when asked about how this will affect people who have catastrophic injuries due to a car accident, a spokesman for the insurance industry basically said that the number of the catastrophic injuries from car accidents is very small. Odd that these incidents are so rare and insignificant yet the money saved by the insurance industry for not having to cover these events offers a big savings to consumers taht is worth back dooring democracy for.

Unless something is done about the costs of health care someone will pay for the 15% savings that this bill will offer. The insurance industry just doesn't want it to be them.

If we weren't so informed we might be Republicans. Or Matt Leinart fans.

Tuesday, October 4, 2011

Friday, September 30, 2011

Not your fathers Republican party

Today's Republican party seems to have one motivation - win. It doesn't matter who they have to scare, what misinformation they have to spread, or what formerly held ideas they have to abandon to make this happen. They just want to win seats and then stack the deck so that they can win more seats in the future.

This is a massive shift away from the Republican party of latter days. Consider some of the ideas that are being challenged by today's Republican legislators.

Today - Wisconsin Governor Republican Scott Walker with the help of the Republican controlled congress has taken on unions and eliminated their collective bargaining rights.

In the Past - Ronald Reagan was the President of the Screen Actors Guild and had this to say about unions:

“Collective bargaining in the years since has played a major role in America’s economic miracle. Unions represent some of the freest institutions in this land. There are few finer examples of participatory democracy to be found anywhere. Too often, discussion about the labor movement concentrates on disputes, corruption, and strikes. But while these things are headlines, there are thousands of good agreements reached and put into practice every year without a hitch.”

Today - Republicans say the rich are taxed too much and that increasing taxes will hurt job creation.

In the Past - John McCain made the following statements long before he twice voted against the Bush tax cuts:

“I don’t think the governor’s tax cut is too big — it’s just misplaced. Sixty percent of the benefits from his tax cuts go to the wealthiest 10% of Americans — and that’s not the kind of tax relief that Americans need. … Gov. Bush wants to spend the entire surplus on tax cuts. I don’t believe the wealthiest 10% of Americans should get 60% of the tax breaks. I think the lowest 10% should get the breaks. …

“I’m not giving tax cuts for the rich.”

Today - Republican legislators insist that tax cuts will lead to the new jobs and economic growth that the US so desperately needs right now.

In the Past - William Gale of the Brookings institute and former economic advisor to George H. W. Bush stated:

Last June, President George W. Bush signed the Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA). This policy brief provides an assessment of the tax cut. Our findings suggest that EGTRRA will reduce the size of the future economy, raise interest rates, make taxes more regressive, increase tax complexity, and prove fiscally unsustainable. These conclusions question the wisdom and affordability of the tax cut and suggest that Congress reconsider the legislation, especially in light of the economic downturn and terrorist attacks that have occurred since last summer.

And He says there's no evidence tax cuts do much to affect economic growth.

Today - Republican legislators have turned against the very fiscal policies that they supported in the past.

In the Past - As David Frum, former economic speechwriter for George W. Bush explains:

It used to be that the dividing line was clear.

Liberals favored active government measures: government spending to fight recessions, tax increases to curtail inflation.

Conservatives by contrast preferred monetary instruments: raise interest rights to stop inflation, loosen money during recessions. ....

Instead, many conservatives have changed their minds. They have turned against quantitative easing. They call for tighter money -- not to battle inflation (there isn't any) but they think the value of the dollar is best measured against the price of some selection of commodities, especially gold, silver and oil. ....

Yet there are only two policy levers, fiscal and monetary, and if you refuse to pull either, you are condemned to do nothing except wait for the economy to improve on its own.

That's left some of us a little isolated. More importantly, it has left conservatives with little useful to say about the greatest economic challenges of our time.

Today - The individual mandate is unconstitutional and proof of the socialist agenda from the left.

In the Past - The individual mandate was the brain child of the conservative Heritage foundation (as evidenced in their quote below) and supported by many Republican legislators including Newt Gingrich.

"[N]either the federal government nor any state requires all households to protect themselves from the potentially catastrophic costs of a serious accident or illness. Under the Heritage plan, there would be such a requirement..."

Today - Some Republican Legislators say social security is a Ponzi scheme that should be eliminated.

In the Past - Long time conservative columnist Charles Krauthhammer recently said:

"Of course it's a Ponzi scheme. So what? It's also the most vital, humane and fixable of all social programs."

Today - Republicans say tax cuts pay for themselves.

In the Past - Bruce Bartlett who worked for both Ronald Reagan and George H.W. Bush said:

"The truth is that the Reagan tax cut never came close to paying for itself, but neither was it expected to lose as much revenue as it did. And while it was highly stimulative, that is only because the economic and financial circumstances of the time made it so. Reenacting some version of the Reagan tax cut under today’s economic conditions would not bring about similar results."

The reality is that today's Republicans are more easily recognized for what they are against than what the stand for and they plan to use obstruction policies at the detriment of the American public and then ride the simpleton mentality of "anybody but" voting back to power.

This is a massive shift away from the Republican party of latter days. Consider some of the ideas that are being challenged by today's Republican legislators.

Today - Wisconsin Governor Republican Scott Walker with the help of the Republican controlled congress has taken on unions and eliminated their collective bargaining rights.

In the Past - Ronald Reagan was the President of the Screen Actors Guild and had this to say about unions:

“Collective bargaining in the years since has played a major role in America’s economic miracle. Unions represent some of the freest institutions in this land. There are few finer examples of participatory democracy to be found anywhere. Too often, discussion about the labor movement concentrates on disputes, corruption, and strikes. But while these things are headlines, there are thousands of good agreements reached and put into practice every year without a hitch.”

Today - Republicans say the rich are taxed too much and that increasing taxes will hurt job creation.

In the Past - John McCain made the following statements long before he twice voted against the Bush tax cuts:

“I don’t think the governor’s tax cut is too big — it’s just misplaced. Sixty percent of the benefits from his tax cuts go to the wealthiest 10% of Americans — and that’s not the kind of tax relief that Americans need. … Gov. Bush wants to spend the entire surplus on tax cuts. I don’t believe the wealthiest 10% of Americans should get 60% of the tax breaks. I think the lowest 10% should get the breaks. …

“I’m not giving tax cuts for the rich.”

Today - Republican legislators insist that tax cuts will lead to the new jobs and economic growth that the US so desperately needs right now.

In the Past - William Gale of the Brookings institute and former economic advisor to George H. W. Bush stated:

Last June, President George W. Bush signed the Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA). This policy brief provides an assessment of the tax cut. Our findings suggest that EGTRRA will reduce the size of the future economy, raise interest rates, make taxes more regressive, increase tax complexity, and prove fiscally unsustainable. These conclusions question the wisdom and affordability of the tax cut and suggest that Congress reconsider the legislation, especially in light of the economic downturn and terrorist attacks that have occurred since last summer.

And He says there's no evidence tax cuts do much to affect economic growth.

Today - Republican legislators have turned against the very fiscal policies that they supported in the past.

In the Past - As David Frum, former economic speechwriter for George W. Bush explains:

It used to be that the dividing line was clear.

Liberals favored active government measures: government spending to fight recessions, tax increases to curtail inflation.

Conservatives by contrast preferred monetary instruments: raise interest rights to stop inflation, loosen money during recessions. ....

Instead, many conservatives have changed their minds. They have turned against quantitative easing. They call for tighter money -- not to battle inflation (there isn't any) but they think the value of the dollar is best measured against the price of some selection of commodities, especially gold, silver and oil. ....

Yet there are only two policy levers, fiscal and monetary, and if you refuse to pull either, you are condemned to do nothing except wait for the economy to improve on its own.

That's left some of us a little isolated. More importantly, it has left conservatives with little useful to say about the greatest economic challenges of our time.

Today - The individual mandate is unconstitutional and proof of the socialist agenda from the left.

In the Past - The individual mandate was the brain child of the conservative Heritage foundation (as evidenced in their quote below) and supported by many Republican legislators including Newt Gingrich.

"[N]either the federal government nor any state requires all households to protect themselves from the potentially catastrophic costs of a serious accident or illness. Under the Heritage plan, there would be such a requirement..."

Today - Some Republican Legislators say social security is a Ponzi scheme that should be eliminated.

In the Past - Long time conservative columnist Charles Krauthhammer recently said:

"Of course it's a Ponzi scheme. So what? It's also the most vital, humane and fixable of all social programs."

Today - Republicans say tax cuts pay for themselves.

In the Past - Bruce Bartlett who worked for both Ronald Reagan and George H.W. Bush said:

"The truth is that the Reagan tax cut never came close to paying for itself, but neither was it expected to lose as much revenue as it did. And while it was highly stimulative, that is only because the economic and financial circumstances of the time made it so. Reenacting some version of the Reagan tax cut under today’s economic conditions would not bring about similar results."

The reality is that today's Republicans are more easily recognized for what they are against than what the stand for and they plan to use obstruction policies at the detriment of the American public and then ride the simpleton mentality of "anybody but" voting back to power.

Tuesday, September 27, 2011

Unions at it again

Those evil unions are at it again. This time it is the UAW.

With the big three returning to profitability, the UAW has just completed negotiations (held GM hostage) on a new contract. Of course this is another awful deal for the big three since it strikes at the very heart of the free market. The UAW had audacity to demand no wage increase for it's members and of course GM caved and accepted. And to make matters worse the UAW forced GM to retain or create 6,400 jobs in America instead of sending this work to Mexico.

I can only assume Scott Walker will be on the phone to the President asking him to step in and abolish this job killing contract. After all if GM has to pay American workers $15 per hour for work that could be done in Mexico how are they going to make enough profit to hire new workers? Our job creators need massive profits to do what their business is set out to do - hire people. This deal does nothing to advance that agenda.

If we continue to let these sort of Socialist/Communist organizations force their unpatriotic agenda down our throats we will all be working for the Chinese before Rick Perry has a chance to save us.

It's time for us to take our country back! I propose that we not only eliminate all corporate taxes but that start paying companies like GM government "thank you" points for doing business in the US. It would be a preemptive strike against countries like Ireland that are willing to do anything to steal our corporations. And the best part is these payments would pay for themselves. How could they not?

The Unions of course are going to try and spin this contract like it is good for the country but in the end we all know, as a Socialist Muslim, President Obama probably supports this contract so it must be bad for America.

Bachmann 2012!

With the big three returning to profitability, the UAW has just completed negotiations (held GM hostage) on a new contract. Of course this is another awful deal for the big three since it strikes at the very heart of the free market. The UAW had audacity to demand no wage increase for it's members and of course GM caved and accepted. And to make matters worse the UAW forced GM to retain or create 6,400 jobs in America instead of sending this work to Mexico.

I can only assume Scott Walker will be on the phone to the President asking him to step in and abolish this job killing contract. After all if GM has to pay American workers $15 per hour for work that could be done in Mexico how are they going to make enough profit to hire new workers? Our job creators need massive profits to do what their business is set out to do - hire people. This deal does nothing to advance that agenda.

If we continue to let these sort of Socialist/Communist organizations force their unpatriotic agenda down our throats we will all be working for the Chinese before Rick Perry has a chance to save us.

It's time for us to take our country back! I propose that we not only eliminate all corporate taxes but that start paying companies like GM government "thank you" points for doing business in the US. It would be a preemptive strike against countries like Ireland that are willing to do anything to steal our corporations. And the best part is these payments would pay for themselves. How could they not?

The Unions of course are going to try and spin this contract like it is good for the country but in the end we all know, as a Socialist Muslim, President Obama probably supports this contract so it must be bad for America.

Bachmann 2012!

Monday, September 26, 2011

Republicans and The Mantra Of Al Davis

The Oakland Raiders have long had a mantra associated with them and, in particular, their rather eccentric owner, Al Davis.

Just Win, Baby!

Use that phrase and even casual NFL fans will know exactly what you're talking about. The Raiders - as personified by the late Jack Tatum and the late Lyle Alzado - were a tough, borderline dirty, team who often led the league in penalties.

What does this have to do with the GOP?

Well, let us look to what is going on concurrently Nebraska and Pennsylvania.

It is probably not commonly known that while John McCain won the state of Nebraska by 15 points in 2008, Barack Obama actually won 1 electoral vote by taking the state congressional district which encompasses the city of Omaha. The GOP obviously didn't like this and are using their large majorities in the 2011 state legislature to change this anomaly.

At the same time, about 1000 miles to the east in Pennsylvania, the GOP are reportedly looking to change their rules to go to the 2008 rules of Nebraska. This would be a huge shift in dampening democracy. A review of the 2008 results show Barack Obama with a 10+ pt win over John McCain; yet, under the proposed rule changes, it is likely that John McCain would have taken more electoral votes from Pennsylvania because he won relatively close margins in huge swaths (geographically) of the state - while Barack Obama won huge margins in the densely populated city of Philadelphia and it's surrounding suburbs.

Clearly there is no underlying principle for the GOP beyond the Al Davis Motto. Whatever it takes. The ends justify the means.

It would be one thing to have President Obama fail to be re-elected in 2012 because of a stalled economy, but it is quite another thing to see the Republicans changing the rules of the game to stack the deck against the Democratic base. This is what has already been going on with the campaign finance laws, voter ID laws, voter registration laws, etc. (That's right... I even linked the "etc"!)

Honestly, it pisses me off. Keep in mind though: the Raiders have not won a Super Bowl since 1984.

We can only hope karma will win in 2012.

Just Win, Baby!

Use that phrase and even casual NFL fans will know exactly what you're talking about. The Raiders - as personified by the late Jack Tatum and the late Lyle Alzado - were a tough, borderline dirty, team who often led the league in penalties.

What does this have to do with the GOP?

Well, let us look to what is going on concurrently Nebraska and Pennsylvania.

It is probably not commonly known that while John McCain won the state of Nebraska by 15 points in 2008, Barack Obama actually won 1 electoral vote by taking the state congressional district which encompasses the city of Omaha. The GOP obviously didn't like this and are using their large majorities in the 2011 state legislature to change this anomaly.

At the same time, about 1000 miles to the east in Pennsylvania, the GOP are reportedly looking to change their rules to go to the 2008 rules of Nebraska. This would be a huge shift in dampening democracy. A review of the 2008 results show Barack Obama with a 10+ pt win over John McCain; yet, under the proposed rule changes, it is likely that John McCain would have taken more electoral votes from Pennsylvania because he won relatively close margins in huge swaths (geographically) of the state - while Barack Obama won huge margins in the densely populated city of Philadelphia and it's surrounding suburbs.

Clearly there is no underlying principle for the GOP beyond the Al Davis Motto. Whatever it takes. The ends justify the means.

It would be one thing to have President Obama fail to be re-elected in 2012 because of a stalled economy, but it is quite another thing to see the Republicans changing the rules of the game to stack the deck against the Democratic base. This is what has already been going on with the campaign finance laws, voter ID laws, voter registration laws, etc. (That's right... I even linked the "etc"!)

Honestly, it pisses me off. Keep in mind though: the Raiders have not won a Super Bowl since 1984.

We can only hope karma will win in 2012.

The Politics of tax policy

In an effort to create jobs the President is asking that the Federal Government spend some money. To pay for these job creating proposals the President has offered up a tax on Americans making over a million dollars a year.

Republican Legislators say this is a "non-starter". They claim that the rich already pay too high of a percentage of the tax bill and they term these millionaires as "job creators".

First it should be noted that less than one percent of small business owners make over a million dollars a year. There a plenty of CEO's, actors, athletes, and celebrity personalities that make over a million dollars a year but to call Mike "the Situation" of Jersey Shore fame a "job creator" is a stretch.

Second, the Federal income tax is not the be all, end all for the taxes that we as Americans pay. Using the Federal income tax rates as your only metric to determine who is taxed too much and who is taxed too little, is like only watching MSNBC or Fox News. You may end up with some political talking points but you will be completely uninformed.

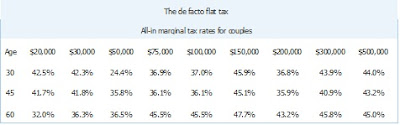

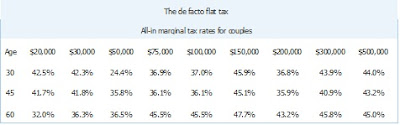

The reality is that we already have what amounts to a national flat tax. The graph below (from MSN) shows the effective tax rates broken down by age and earnings.

While it may be true that the rich pay a higher percentage of their wages in the Federal income tax system than the poor, it is also true that the poor pay a much higher percentage of their wages in sales tax. To make matters worse the numbers above were from 2007 and the sales tax rates just reached new record highs. This means what little savings the poor had over the rich four years ago has likely disappeared.

So while Republican legislators continue to push for higher taxes on the poor ("broadening the tax base") their refusal to increase taxes and the subsequent shortfall in federal funding for states has already produced the affect of raising taxes on the poor as states increase sales taxes to offset the losses.

There are plenty of ideological differences on job creation that deserve debate but this obstruction based on half truths is pure demagoguery. Being a Devils advocate should be an instrument of debate not a political position.

Republican Legislators say this is a "non-starter". They claim that the rich already pay too high of a percentage of the tax bill and they term these millionaires as "job creators".

First it should be noted that less than one percent of small business owners make over a million dollars a year. There a plenty of CEO's, actors, athletes, and celebrity personalities that make over a million dollars a year but to call Mike "the Situation" of Jersey Shore fame a "job creator" is a stretch.

Second, the Federal income tax is not the be all, end all for the taxes that we as Americans pay. Using the Federal income tax rates as your only metric to determine who is taxed too much and who is taxed too little, is like only watching MSNBC or Fox News. You may end up with some political talking points but you will be completely uninformed.

The reality is that we already have what amounts to a national flat tax. The graph below (from MSN) shows the effective tax rates broken down by age and earnings.

While it may be true that the rich pay a higher percentage of their wages in the Federal income tax system than the poor, it is also true that the poor pay a much higher percentage of their wages in sales tax. To make matters worse the numbers above were from 2007 and the sales tax rates just reached new record highs. This means what little savings the poor had over the rich four years ago has likely disappeared.

So while Republican legislators continue to push for higher taxes on the poor ("broadening the tax base") their refusal to increase taxes and the subsequent shortfall in federal funding for states has already produced the affect of raising taxes on the poor as states increase sales taxes to offset the losses.

There are plenty of ideological differences on job creation that deserve debate but this obstruction based on half truths is pure demagoguery. Being a Devils advocate should be an instrument of debate not a political position.

Michael Strahan is a Man of The People

I think all of us can relate to this.

On yesterday's Fox NFL Sunday Show, Curt Menafee alluded to how the Philadelphia Eagles have shifted their starting LBs by moving each to a different position (while keeping the same three guys). Here is the response of Michael Strahan:

That's just like having three of the same car and you switch 'em around. You still have the same three cars.

Absolutely! I know I have trouble deciding which of my three Beemers I should take to work each day! I usually just take the red one because it goes well with the sign at TGIFs.

On yesterday's Fox NFL Sunday Show, Curt Menafee alluded to how the Philadelphia Eagles have shifted their starting LBs by moving each to a different position (while keeping the same three guys). Here is the response of Michael Strahan:

That's just like having three of the same car and you switch 'em around. You still have the same three cars.

Absolutely! I know I have trouble deciding which of my three Beemers I should take to work each day! I usually just take the red one because it goes well with the sign at TGIFs.

Wednesday, September 21, 2011

Taxation as a political tool

The president has put out his vision of a jobs plan and Republicans have, not surprisingly, gone on record as to why this jobs plan is awful. Chief among their complaints is the standard claim of "class warfare".

There is a bit of a self full filling prophecy at work here. The Republican plan for job creation requires a reduction in taxes yet the statistics show that the Bush tax cuts, while reducing taxes for everyone, increased the percentage of taxes paid by the rich even though they get the same amount, if not more, tax free money than the poor (taxes paid by the top 10% increased to 72.8% in 2005 from 67.8% in 2001). This high percentage is the exact rationale used to suggest that the rich pay too much in taxes. The solution to this perceived problem, as you can probably guess, is to lower taxes which of course will only further exaggerate the problem and then we are right back to where we started.

The other possible solution to the problem of the rich paying a disproportionate amount of taxes is one of the main talking points on the Republican campaign trail right now. They want to "broaden the tax base". This means they want to raise taxes by eliminating some tax deductions, credits and exemptions. Unfortunately done independently this would increase taxes, which Republicans in Washington, are morally opposed to given their rigid adherence to "the pledge". So, the Republican candidates are offering offsetting tax cuts by lowering the marginal tax rates.

There is of course already a term for this plan. It is called "class warfare". Broadening the tax base means making sure more people pay taxes. With the exception of around 5% of the rich that make up that 47%, broadening the tax base means taxing the poor and elderly. And reducing the marginal tax rates means tax cuts for the rich.

The result is less money for those who are most likely to spend it and more for those who are most likely to save it which would have a negative impact on the economy and do nothing to reduce the national debt which was of paramount importance only two months ago.

So yes our politicians are waging class warfare. The President is waging his against the rich and Republicans are waging theirs against the poor. Unfortunately the term class warfare answers no questions and represents no solutions. It is a sound bite for the simplistic that may gain votes, but costs us a chance at real economic progress.

There is a bit of a self full filling prophecy at work here. The Republican plan for job creation requires a reduction in taxes yet the statistics show that the Bush tax cuts, while reducing taxes for everyone, increased the percentage of taxes paid by the rich even though they get the same amount, if not more, tax free money than the poor (taxes paid by the top 10% increased to 72.8% in 2005 from 67.8% in 2001). This high percentage is the exact rationale used to suggest that the rich pay too much in taxes. The solution to this perceived problem, as you can probably guess, is to lower taxes which of course will only further exaggerate the problem and then we are right back to where we started.

The other possible solution to the problem of the rich paying a disproportionate amount of taxes is one of the main talking points on the Republican campaign trail right now. They want to "broaden the tax base". This means they want to raise taxes by eliminating some tax deductions, credits and exemptions. Unfortunately done independently this would increase taxes, which Republicans in Washington, are morally opposed to given their rigid adherence to "the pledge". So, the Republican candidates are offering offsetting tax cuts by lowering the marginal tax rates.

There is of course already a term for this plan. It is called "class warfare". Broadening the tax base means making sure more people pay taxes. With the exception of around 5% of the rich that make up that 47%, broadening the tax base means taxing the poor and elderly. And reducing the marginal tax rates means tax cuts for the rich.

The result is less money for those who are most likely to spend it and more for those who are most likely to save it which would have a negative impact on the economy and do nothing to reduce the national debt which was of paramount importance only two months ago.

So yes our politicians are waging class warfare. The President is waging his against the rich and Republicans are waging theirs against the poor. Unfortunately the term class warfare answers no questions and represents no solutions. It is a sound bite for the simplistic that may gain votes, but costs us a chance at real economic progress.

Monday, September 19, 2011

Romneycare under attack

Rick Perry has decided to attack Mitt Romney for the health care reforms that he implemented while Governor of Massachusetts. The attacks seem to be based on the fact that the ACA passed under President Obama was modeled after the Massachusetts reforms which, when considered as a package, does not poll very well (especially among Republicans).

Perry has been making claims about how much "Romneycare" cost Americans which runs counter the the reports on health care reform by the CBO. Even if these claims are true there is one very important statistic in this debate that Rick Perry is ignoring - results.

While cost maybe a major concern for most Americans when going to see the doctor I would guess it would fall a distant second to getting better. Over the past several years a number of states have implemented some type of government funded health care reform trending towards universal health care. Below is a list of these states and how they stack up to other states when considering patient outcomes (1 being the best and 50 being the worst).

Minnesota - 1

Massachusetts - 3

Iowa - 4

Vermont - 5

Connecticut - 7

Colorado - 9

New York - 11

Oregon - 13

New Jersey - 14

Wisconsin - 15

California - 16

Maine - 20

Kansas - 21

Pennsylvania - 31

It should also be noted that number 2 on this list is Hawaii which has had their own health care mandate in place since 1974. For those of you keeping score at home the state of Texas, which Rick Perry is the governor of, ranks ahead of only one of these states at 26th.

I concede that it is certainly possible that it is fluke that all of the top 5 and 12 out of the top 16 states when it comes to health care outcomes happen to be those that are moving towards universal health care systems. But when you consider how low the US health care ranking is when compared to other nations that do offer universal health care and combine that with the rankings above there seems to be a correlation between implementing aspects of universal health care and improved patient outcomes.

The question should be, when you go to the hospital, would you prefer that they save you money or save your life? Rick Perry is betting that you pick money.

Perry has been making claims about how much "Romneycare" cost Americans which runs counter the the reports on health care reform by the CBO. Even if these claims are true there is one very important statistic in this debate that Rick Perry is ignoring - results.

While cost maybe a major concern for most Americans when going to see the doctor I would guess it would fall a distant second to getting better. Over the past several years a number of states have implemented some type of government funded health care reform trending towards universal health care. Below is a list of these states and how they stack up to other states when considering patient outcomes (1 being the best and 50 being the worst).

Minnesota - 1

Massachusetts - 3

Iowa - 4

Vermont - 5

Connecticut - 7

Colorado - 9

New York - 11

Oregon - 13

New Jersey - 14

Wisconsin - 15

California - 16

Maine - 20

Kansas - 21

Pennsylvania - 31

It should also be noted that number 2 on this list is Hawaii which has had their own health care mandate in place since 1974. For those of you keeping score at home the state of Texas, which Rick Perry is the governor of, ranks ahead of only one of these states at 26th.

I concede that it is certainly possible that it is fluke that all of the top 5 and 12 out of the top 16 states when it comes to health care outcomes happen to be those that are moving towards universal health care systems. But when you consider how low the US health care ranking is when compared to other nations that do offer universal health care and combine that with the rankings above there seems to be a correlation between implementing aspects of universal health care and improved patient outcomes.

The question should be, when you go to the hospital, would you prefer that they save you money or save your life? Rick Perry is betting that you pick money.

Friday, September 9, 2011

Job creation

Recent Republican dogma suggests that government can't create jobs, yet they also feel it is important to have someone who has been a job creator in office. They say this as though looking through past presidents there is some correlation between the business acumen of the President and job creation. Ironically Rick Perry is currently the leading candidate for the Republican nomination and has a record of job creation in Texas that he is sure to run on yet he has no experience in business.

It seems be a fallacy that those who have created jobs in the private industry are somehow more qualified to create jobs from public office.

There also seems to be a considerable amount of debate recently on the "job killing" capability of government regulations. Unfortunately measuring the number of jobs that are not in existence due to something like say regulations or jobs not lost due to something like say stimulus, is a very hard thing to determine and prove with any accuracy. But what we do know is that small businesses concerns over government regulations, if a concern at all, are very low on the totem pole.

The top concerns for small business are Economic Uncertainty and Lack of Sales. Even massive repeals or changes in current government regulations will have little or no effect on either of these items. Future regulations could account for some of the concern over Economic Uncertainty. For his part the President did put some impending regulations on hold to quell some of these fears.

We also know that consumer confidence has a high correlation with consumption expenditures. Meaning higher consumer confidence leads to more consumer spending and more consumer spending clearly affects the lack of sales that in turn affects hiring.

So while our politicians talk about job creation as a number one priority their actions have a much greater affect. The vastly political debate over increasing the debt ceiling turned National Debt debate, caused a near 20 point drop in consumer confidence putting us at just 12 points above our great recession low. While we may have made some minor improvements regarding the national debt all of those gains may have been lost by the correlating drop in consumer spending from the massive decrease in consumer confidence. This partisan gamesmanship might be some of that Economic Uncertainty that is keeping private industry from hiring.

It should also be noted that all of the austerity measures that have been pushed for recently have cost a great number of jobs while forcing states to look elsewhere for funding. This has in turn lead to the highest average sales tax rate in our nations history. This has essentially lead to a shift in the tax burden to the poor who spend the greatest percentage of their income which again means less consumer spending.

I have no doubt that the majority of Republicans legislators believe they are doing what is best for the country but the empirical evidence suggests that their actions are having unintended results that run counter to their stated goal.

Perhaps Republican legislators are much more aware of their policy affects on job creation than I given them credit for since every legislative effort they support, proves their dogma that the government can't create jobs - a sort of self-fulfilling prophecy policy.

It seems be a fallacy that those who have created jobs in the private industry are somehow more qualified to create jobs from public office.

There also seems to be a considerable amount of debate recently on the "job killing" capability of government regulations. Unfortunately measuring the number of jobs that are not in existence due to something like say regulations or jobs not lost due to something like say stimulus, is a very hard thing to determine and prove with any accuracy. But what we do know is that small businesses concerns over government regulations, if a concern at all, are very low on the totem pole.

The top concerns for small business are Economic Uncertainty and Lack of Sales. Even massive repeals or changes in current government regulations will have little or no effect on either of these items. Future regulations could account for some of the concern over Economic Uncertainty. For his part the President did put some impending regulations on hold to quell some of these fears.

We also know that consumer confidence has a high correlation with consumption expenditures. Meaning higher consumer confidence leads to more consumer spending and more consumer spending clearly affects the lack of sales that in turn affects hiring.

So while our politicians talk about job creation as a number one priority their actions have a much greater affect. The vastly political debate over increasing the debt ceiling turned National Debt debate, caused a near 20 point drop in consumer confidence putting us at just 12 points above our great recession low. While we may have made some minor improvements regarding the national debt all of those gains may have been lost by the correlating drop in consumer spending from the massive decrease in consumer confidence. This partisan gamesmanship might be some of that Economic Uncertainty that is keeping private industry from hiring.

It should also be noted that all of the austerity measures that have been pushed for recently have cost a great number of jobs while forcing states to look elsewhere for funding. This has in turn lead to the highest average sales tax rate in our nations history. This has essentially lead to a shift in the tax burden to the poor who spend the greatest percentage of their income which again means less consumer spending.

I have no doubt that the majority of Republicans legislators believe they are doing what is best for the country but the empirical evidence suggests that their actions are having unintended results that run counter to their stated goal.

Perhaps Republican legislators are much more aware of their policy affects on job creation than I given them credit for since every legislative effort they support, proves their dogma that the government can't create jobs - a sort of self-fulfilling prophecy policy.

Thursday, September 8, 2011

Whose Economy is this anyway

One of the biggest disappointments of 2011 is how little influence the President has exerted over policy. This is one of the main reasons for his falling poll numbers as Democrats become disillusioned with a President who has done little to nothing to push the agenda that he campaigned on.

To the Republicans credit they have essentially controlled the message and the agenda since the November elections. This includes attacking unions, continuing unsustainably low tax rates, cutting business taxes, making regulations a center piece of job creation, obsessing over the National Debt, limiting as many welfare benefits as possible, and of course limiting abortions and expanding gun rights where ever possible.

The good news for Democrats is that the economy is no longer their problem. In July of 2009, after less than six months in office Eric Cantor said "Simply put, this is now President Obama's economy". Since the Democrats have essentially been rendered impotent by Republican control coupled with legislative procedures and the President has caved on every issue that has come to the fore over the past ten months that must mean simply put, this is now the Republicans economy.

Is this true? Maybe. Maybe not. But that is not really important in today's political climate. The goal has become to discredit the man behind the policy or the argument rather than actually debating the argument the man makes. Why come up with counter facts to support your position when you can just discredit the person making the argument?

This is the sort of tactic that bore the Birther's, the Bill Ayers conspirators, and the "Obama is a Muslim" phenomenon. None of these topics have anything to do with the President's implementation of Keynesian economics or the results of the Stimulus Package but they sure make for effective political tools to rally the base.

Both sides of the aisle have ideas for how to create jobs. Some good and some bad. In the past Legislators would have sat down and had some give and take and thrown a bunch of ideas at the wall to see what sticks. Today we live in a world where political posturing outweighs action. Unfortunately the only jobs that are created under these circumstances are in Political Action Committees, Lobbyist offices, and media punditry. And it's all the Republicans fault!

To the Republicans credit they have essentially controlled the message and the agenda since the November elections. This includes attacking unions, continuing unsustainably low tax rates, cutting business taxes, making regulations a center piece of job creation, obsessing over the National Debt, limiting as many welfare benefits as possible, and of course limiting abortions and expanding gun rights where ever possible.

The good news for Democrats is that the economy is no longer their problem. In July of 2009, after less than six months in office Eric Cantor said "Simply put, this is now President Obama's economy". Since the Democrats have essentially been rendered impotent by Republican control coupled with legislative procedures and the President has caved on every issue that has come to the fore over the past ten months that must mean simply put, this is now the Republicans economy.

Is this true? Maybe. Maybe not. But that is not really important in today's political climate. The goal has become to discredit the man behind the policy or the argument rather than actually debating the argument the man makes. Why come up with counter facts to support your position when you can just discredit the person making the argument?

This is the sort of tactic that bore the Birther's, the Bill Ayers conspirators, and the "Obama is a Muslim" phenomenon. None of these topics have anything to do with the President's implementation of Keynesian economics or the results of the Stimulus Package but they sure make for effective political tools to rally the base.

Both sides of the aisle have ideas for how to create jobs. Some good and some bad. In the past Legislators would have sat down and had some give and take and thrown a bunch of ideas at the wall to see what sticks. Today we live in a world where political posturing outweighs action. Unfortunately the only jobs that are created under these circumstances are in Political Action Committees, Lobbyist offices, and media punditry. And it's all the Republicans fault!

Wednesday, September 7, 2011

CLEAR Act of 2011 - Guest Post

This today from Roland Tomassi.

As I read through the summary of HR.100 CLEAR Act of 2011, my mind kept telling me that this has to be a group of Democrats, who are out of touch with their base. The summary ( located Here ) starts off by saying that states that do not comply with the new law will lose funding (thus, taking away states rights, and making a stronger federal government), will provide “ federal reimbursement for related state and local costs.”, and will also make grants to government agencies for special equipment and facilities, (so yes, more federal spending).

How can this be anything other than CLEAR demonstration of Democrats making a power grab for the federal government to hold more power, and to spend more of our hard earned tax dollars. But then I get really confused, because later in the summary, it describes how personnel who are involved in the carrying out of their duties under this new law would be immune from personal liability and monetary liability for civil rights violations, unless those violations violated criminal law. So the civil rights granted under the Constitution are not enforceable against these personnel, unless they violate criminal law.

Since I’m so used to hearing from my Republican friends that it’s the democrats who hate the Constitution, I am sure this is a Democrat bill now. I mean, who else would think that making a larger federal government, spending more federal money, and disregarding the Constitution would be a good idea. Oh, well it would be the following sponsor and co sponsors of the bill.

Sponsored by

• Rep. Marsha Blackburn (TN Republican)

Co-Sponsored by

• Rep. Spencer Bachus (AL Republican)

• Rep. Ken Calvert (CA Republican)

• Rep. John Carter (TX Republican)

• Rep. David Dreier (CA Republican)

• Rep. Trent Franks (AZ Republican)

• Rep. Robert Goodlatte (VA Republican)

• Rep. Samuel Johnson (TX Republican)

• Rep. Walter Jones (NC Republican)

• Rep. John Kline (MN Republican)

• Rep. Thaddeus Mccotter (MI Republican)

• Rep. Gary Miller (CA Republican)

• Rep. Sue Myrick (NC Republican)

• Rep. Michael Rogers (MI Republican)

• Rep. Edward Royce (CA Republican)

• Rep. Peter Sessions (TX Republican)

• Rep. Michael Turner (OH Republican)

• Rep. Brian Bilbray (CA Republican)

• Rep. Tom Price (GA Republican)

• Rep. Geoff Davis (KY Republican)

• Rep. Michael Fitzpatrick (PA Republican)

• Rep. Kenny Marchant (TX Republican)

• Senator Dean Heller (NV Republican)

• Rep. Jason Chaffetz (UT Republican)

• Rep. Mike Coffman (CO Republican)

• Rep. Duncan Hunter (CA Republican)

• Rep. Lynn Jenkins (KS Republican)

• Rep. Bill Posey (FL Republican)

• Rep. Mo Brooks (AL Republican)

• Rep. Paul Gosar (AZ Republican)

• Rep. Dennis Ross (FL Republican)

• Rep. Andy Harris (MD Republican)

• Rep. Dan Benishek (MI Republican)

• Rep. Lou Barletta (PA Republican)

• Rep. Diane Black (TN Republican)

• Rep. Bill Flores (TX Republican)

• Rep. David Mckinley (WV Republican)

Now hold on… there is not a Democrat on that list. I’m so confused, when did Republicans want to do all those things. Oh yeah, when ever it’s about Illegal Immigrants. My bad.

As I read through the summary of HR.100 CLEAR Act of 2011, my mind kept telling me that this has to be a group of Democrats, who are out of touch with their base. The summary ( located Here ) starts off by saying that states that do not comply with the new law will lose funding (thus, taking away states rights, and making a stronger federal government), will provide “ federal reimbursement for related state and local costs.”, and will also make grants to government agencies for special equipment and facilities, (so yes, more federal spending).

How can this be anything other than CLEAR demonstration of Democrats making a power grab for the federal government to hold more power, and to spend more of our hard earned tax dollars. But then I get really confused, because later in the summary, it describes how personnel who are involved in the carrying out of their duties under this new law would be immune from personal liability and monetary liability for civil rights violations, unless those violations violated criminal law. So the civil rights granted under the Constitution are not enforceable against these personnel, unless they violate criminal law.

Since I’m so used to hearing from my Republican friends that it’s the democrats who hate the Constitution, I am sure this is a Democrat bill now. I mean, who else would think that making a larger federal government, spending more federal money, and disregarding the Constitution would be a good idea. Oh, well it would be the following sponsor and co sponsors of the bill.

Sponsored by

• Rep. Marsha Blackburn (TN Republican)

Co-Sponsored by

• Rep. Spencer Bachus (AL Republican)

• Rep. Ken Calvert (CA Republican)

• Rep. John Carter (TX Republican)

• Rep. David Dreier (CA Republican)

• Rep. Trent Franks (AZ Republican)

• Rep. Robert Goodlatte (VA Republican)

• Rep. Samuel Johnson (TX Republican)

• Rep. Walter Jones (NC Republican)

• Rep. John Kline (MN Republican)

• Rep. Thaddeus Mccotter (MI Republican)

• Rep. Gary Miller (CA Republican)

• Rep. Sue Myrick (NC Republican)

• Rep. Michael Rogers (MI Republican)

• Rep. Edward Royce (CA Republican)

• Rep. Peter Sessions (TX Republican)

• Rep. Michael Turner (OH Republican)

• Rep. Brian Bilbray (CA Republican)

• Rep. Tom Price (GA Republican)

• Rep. Geoff Davis (KY Republican)

• Rep. Michael Fitzpatrick (PA Republican)

• Rep. Kenny Marchant (TX Republican)

• Senator Dean Heller (NV Republican)

• Rep. Jason Chaffetz (UT Republican)

• Rep. Mike Coffman (CO Republican)

• Rep. Duncan Hunter (CA Republican)

• Rep. Lynn Jenkins (KS Republican)

• Rep. Bill Posey (FL Republican)

• Rep. Mo Brooks (AL Republican)

• Rep. Paul Gosar (AZ Republican)

• Rep. Dennis Ross (FL Republican)

• Rep. Andy Harris (MD Republican)

• Rep. Dan Benishek (MI Republican)

• Rep. Lou Barletta (PA Republican)

• Rep. Diane Black (TN Republican)

• Rep. Bill Flores (TX Republican)

• Rep. David Mckinley (WV Republican)

Now hold on… there is not a Democrat on that list. I’m so confused, when did Republicans want to do all those things. Oh yeah, when ever it’s about Illegal Immigrants. My bad.

What. The. F?!?!, Or Ato Bolden Is A Flip-Flopper

Last week, I made a bold prediction in contradicting Ato Bolden in his statement that Carmelita Jeter would win the 200m at the World T&F Championships in Daegu.

I correctly called that Jeter would lose to Veronica Campbell-Brown of Jamaica. I'm not going to lie, I was feeling pretty boastful. I even texted Elijah Moon (the biggest Tim Toone fan I know). Only to have them drop this one me on night coverage on Universal:

Studio Host: You (Ato) said it. One of the greatest fields ever assembled for the women's 200m final and VCB came through just like you predicted.

Ato: Yeah, it's probably the only prediction that I've had right from one to three.

What?!?! That is NOT what he said. At all. That is kind of annoying. It makes me wonder if Ato Bolden isn't out there reading this blog for tips. If we see him out there helping drive the Derek Anderson Bandwagon, I think we'll have our answer. (In fact, we (well, I) would welcome Ato on the DAB... it can be a pretty lonesome ride.)

I correctly called that Jeter would lose to Veronica Campbell-Brown of Jamaica. I'm not going to lie, I was feeling pretty boastful. I even texted Elijah Moon (the biggest Tim Toone fan I know). Only to have them drop this one me on night coverage on Universal:

Studio Host: You (Ato) said it. One of the greatest fields ever assembled for the women's 200m final and VCB came through just like you predicted.

Ato: Yeah, it's probably the only prediction that I've had right from one to three.

What?!?! That is NOT what he said. At all. That is kind of annoying. It makes me wonder if Ato Bolden isn't out there reading this blog for tips. If we see him out there helping drive the Derek Anderson Bandwagon, I think we'll have our answer. (In fact, we (well, I) would welcome Ato on the DAB... it can be a pretty lonesome ride.)

Friday, September 2, 2011

Job Killing Regulators?

While I have fully come to expect a misinformed view of reality from organizations with an agenda like Fox News I had assumed this was not be a tactic of my State Representatives. Recently Tim Walberg posted on his facebook page the following statement:

Since 08', 281,000 new regulators have been added, while private-sector jobs shrank by 5.6%. Regulatory agencies have seen their combined budgets grow a healthy 16% since 2008, topping $54 billion.

The article linked below is quote is titled "Regulation Business, Jobs Booming Under Obama".

Ignoring for a moment that I was told that Tim Walberg does not have an agenda when it comes to regulations, it should be noted that the 2008 budget, which would include the hiring of new regulators, was put in place by George W. Bush, not President Obama. Attributing all of the increases to Obama is either willful neglect or intentionally misleading.

Obviously the goal of this facebook post is to rally people behind the idea of cutting regulations under that notion that regulations kill jobs. Unfortunately there is no context behind these numbers to support this idea.

Given this I wanted to give people an understanding of the actual numbers behind the increases in jobs and spending associated with government regulations.

First, I would like to point out that Mr. Walberg's first statement is factually inaccurate according to his own link. He says that "Since 08', 281,000 new regulators have been added". The reality is that there is only a total of around 281,000 regulators working for the Federal government and only 26,202 of those jobs have been added since 2008. Then again maybe this wasn't meant to be a factual statement.

Of those 26,202 jobs 63% of them (16,633) are Homeland Security Regulators. Is Mr. Walberg suggesting we should cut back on Homeland Security Regulators? Another 3,583 of the added regulators were in the area of Consumer Safety and Health. Vast majorities of the public happen to support stricter regulations for food safety, safety of pharmaceuticals, air and water pollution, and consumer product safety. I imagine that means that vast majorities are not against increased spending on Consumer Safety and Health regulators.

All told Economic Regulators, which I assume are the ones Mr. Walberg would consider to be some of the most "Job Killing", only make up just under 14% of the regulators on federal payrolls.

Even if you attribute the increases in regulators and subsequent spending from 2008 to Obama, as Mr. Walberg is doing, Obama has only increased regulatory employment by 3.3% and spending by 1.8% per year while under George W. Bush employment increased by an average of 5.7% per year and spending on regulators increased by 7.5% per year.

Additionally, while the article Tim Walberg is errantly quoting from shows that since 2008 federal regulatory spending has increased by 16%, that three year total increase would rank 5th all time in the single year increases in regulatory spending, following increases of 24.3% and 16.4% by George W. Bush in 2003 and 2002 and 20% and 19.6% by Richard Nixon in 1973 and 1971. To the extent that we have a spending problem regarding government regulators, it has been the problem of Republican Presidents.

Perhaps the bigger concern for tax payers should be that we have a Federal employee and his staff that don't take the time to fact check before broadcasting information to the world. Talk about a waste of tax payer dollars. But then again what do I know, I'm just a blogger and this information did require two different Internet searches ( here and here ).

Since 08', 281,000 new regulators have been added, while private-sector jobs shrank by 5.6%. Regulatory agencies have seen their combined budgets grow a healthy 16% since 2008, topping $54 billion.

The article linked below is quote is titled "Regulation Business, Jobs Booming Under Obama".

Ignoring for a moment that I was told that Tim Walberg does not have an agenda when it comes to regulations, it should be noted that the 2008 budget, which would include the hiring of new regulators, was put in place by George W. Bush, not President Obama. Attributing all of the increases to Obama is either willful neglect or intentionally misleading.

Obviously the goal of this facebook post is to rally people behind the idea of cutting regulations under that notion that regulations kill jobs. Unfortunately there is no context behind these numbers to support this idea.

Given this I wanted to give people an understanding of the actual numbers behind the increases in jobs and spending associated with government regulations.

First, I would like to point out that Mr. Walberg's first statement is factually inaccurate according to his own link. He says that "Since 08', 281,000 new regulators have been added". The reality is that there is only a total of around 281,000 regulators working for the Federal government and only 26,202 of those jobs have been added since 2008. Then again maybe this wasn't meant to be a factual statement.

Of those 26,202 jobs 63% of them (16,633) are Homeland Security Regulators. Is Mr. Walberg suggesting we should cut back on Homeland Security Regulators? Another 3,583 of the added regulators were in the area of Consumer Safety and Health. Vast majorities of the public happen to support stricter regulations for food safety, safety of pharmaceuticals, air and water pollution, and consumer product safety. I imagine that means that vast majorities are not against increased spending on Consumer Safety and Health regulators.

All told Economic Regulators, which I assume are the ones Mr. Walberg would consider to be some of the most "Job Killing", only make up just under 14% of the regulators on federal payrolls.

Even if you attribute the increases in regulators and subsequent spending from 2008 to Obama, as Mr. Walberg is doing, Obama has only increased regulatory employment by 3.3% and spending by 1.8% per year while under George W. Bush employment increased by an average of 5.7% per year and spending on regulators increased by 7.5% per year.

Additionally, while the article Tim Walberg is errantly quoting from shows that since 2008 federal regulatory spending has increased by 16%, that three year total increase would rank 5th all time in the single year increases in regulatory spending, following increases of 24.3% and 16.4% by George W. Bush in 2003 and 2002 and 20% and 19.6% by Richard Nixon in 1973 and 1971. To the extent that we have a spending problem regarding government regulators, it has been the problem of Republican Presidents.

Perhaps the bigger concern for tax payers should be that we have a Federal employee and his staff that don't take the time to fact check before broadcasting information to the world. Talk about a waste of tax payer dollars. But then again what do I know, I'm just a blogger and this information did require two different Internet searches ( here and here ).

Thursday, September 1, 2011

Just Puttin' It Out There

I think Carmelita Jeter goes into this race as the favorite... given her confidence and having that gold medal that she's worked for three World Championships to get, I don't see how they're going to deal with (her) in this 200 (meter race)... they will literally have to hope that she runs out of gas for them to beat her. -- Ato Bolden

Unlike some announcers (*cough* Matt Millen), I have to acknowledge that Ato Bolden has probably forgotten more about his sport (sprinting) than I will likely ever know. That said, occasionally, we like to use this blog to make a fearless prediction; I think Ato Bolden is wrong. I have too much respect for Bolden to tag this with "I Call Bullshit", but I really do not think Carmelita Jeter will win the 200 meters. Jeter may not even make the podium.

I hate to say it, but I'm predicting a Veronica Campbell-Brown victory at 200 meters. Just for the hell of it, I will also predict Allyson Felix and Shalonda Salomon will also beat Jeter. I don't know if I truly believe that part --- but the point stands, Jeter loses to VCB.

Unlike some announcers (*cough* Matt Millen), I have to acknowledge that Ato Bolden has probably forgotten more about his sport (sprinting) than I will likely ever know. That said, occasionally, we like to use this blog to make a fearless prediction; I think Ato Bolden is wrong. I have too much respect for Bolden to tag this with "I Call Bullshit", but I really do not think Carmelita Jeter will win the 200 meters. Jeter may not even make the podium.

I hate to say it, but I'm predicting a Veronica Campbell-Brown victory at 200 meters. Just for the hell of it, I will also predict Allyson Felix and Shalonda Salomon will also beat Jeter. I don't know if I truly believe that part --- but the point stands, Jeter loses to VCB.

Monday, August 29, 2011

Tim Walberg - Good Solider

A few weeks back the communications director for Tim Walberg called me to let me know that he felt I was misrepresenting the facts of a previous post of mine about a conversation I had with a staffer regarding government regulations. In essence I was told that Mr. Walberg was just gathering information about how regulations affect business and that there was no agenda behind the call.

What I fail to understand about this defense is that the Representative's own website has an article titled: "Rep Tim Walberg Focuses on Job-Destroying Regulations". It's clear he is against a litany of government regulations. Why run from that fact? If there is good rationale behind your objectives you should tout them.

Also during my conversation I was told that job creation is Tim Walberg's number one priority. When I asked for proof of that I was given two links. Here and here. Both of these links show that Tim Walberg is for cutting taxes and reducing regulations. This is hardly revolutionary thinking. It happens to be the same principles that George W. Bush governed under for 8 years. The record would indicate that job creation was dismal for those 8 years.

The reality is that Tim Walberg has sponsored two pieces of legislation. One on February 14th seeking a moratorium on Flood Insurance Rate Maps and one on February 16th basically preempting any regulations that the EPA may try and enforce. He has also signed on as a co-sponsor to a number of pieces of legislation but if you look though them you will see the vast majority of them are for restricting abortion, limiting restrictions on guns, reducing taxes, eliminating government regulations, and generally attempting to repeal anything that the President has supported. That is not to say that he hasn't co-sponsored or voted for any reasonable legislation but there is very little there to support the notion that Tim Walberg has made job creation his number one priority.

If you look at the second link above to Eric Cantor's "Jobs Legislation Tracker" you will see that 50% of what Republicans consider job creation legislation is in the reducing regulations category. While government regulations may cost jobs, like most everything else Republican legislators have gone after lately, the emphasis is not appropriate to the benefits. The number of jobs created by ending government regulations is relatively small when compared with something like infrastructure spending that the President will propose (and Republicans will oppose) next week.

Of course the thing that Tim Walberg and his Republican colleagues won't tell you is the costs for removing regulations. While government regulations may cost jobs and more money for tax payers, they don't cost lives. The gulf oil spill and the West Virginia mining accidents were due in part to a lack of a proper regulatory system. It should also be noted that the removal of regulations was a major contributor to the housing bubble that led to the most recent economic downturn, costing around 8 million jobs.

It would also be a mistake to focus solely on the costs of regulations without acknowledging the benefits. By continuing to reduce regulations we run the risk of serious public health issues like the Chinese toothpaste that was tainted with poison. By in large government regulations follow the government mandate of being "for the public good". Just because a regulation has detractors doesn't mean that it should be repealed.

The other point I would like to make is that in a recent survey of 250 economists who work in corporate America, 80% of the economists termed the currently regulatory environment as "good". The other 20% was split between "bad" and "unsure". If regulations are such a burden on corporate America shouldn't they be aware of this? It is tough to say that corporate America is being held back by government regulations when less than 20% of corporate America agrees with that statement.

In some sense I really wish Tim Walberg would admit that he has an agenda since then at least he could show he stands for something. By claiming to be impartial and then voting with Republicans 93% of the time while only sponsoring two pieces of legislation Tim Walberg has proven he is just a good solider, not a valued leader. In this political climate we need leaders with ideas otherwise rhetoric like jobs are number one come of sounding like number two.

What I fail to understand about this defense is that the Representative's own website has an article titled: "Rep Tim Walberg Focuses on Job-Destroying Regulations". It's clear he is against a litany of government regulations. Why run from that fact? If there is good rationale behind your objectives you should tout them.

Also during my conversation I was told that job creation is Tim Walberg's number one priority. When I asked for proof of that I was given two links. Here and here. Both of these links show that Tim Walberg is for cutting taxes and reducing regulations. This is hardly revolutionary thinking. It happens to be the same principles that George W. Bush governed under for 8 years. The record would indicate that job creation was dismal for those 8 years.

The reality is that Tim Walberg has sponsored two pieces of legislation. One on February 14th seeking a moratorium on Flood Insurance Rate Maps and one on February 16th basically preempting any regulations that the EPA may try and enforce. He has also signed on as a co-sponsor to a number of pieces of legislation but if you look though them you will see the vast majority of them are for restricting abortion, limiting restrictions on guns, reducing taxes, eliminating government regulations, and generally attempting to repeal anything that the President has supported. That is not to say that he hasn't co-sponsored or voted for any reasonable legislation but there is very little there to support the notion that Tim Walberg has made job creation his number one priority.

If you look at the second link above to Eric Cantor's "Jobs Legislation Tracker" you will see that 50% of what Republicans consider job creation legislation is in the reducing regulations category. While government regulations may cost jobs, like most everything else Republican legislators have gone after lately, the emphasis is not appropriate to the benefits. The number of jobs created by ending government regulations is relatively small when compared with something like infrastructure spending that the President will propose (and Republicans will oppose) next week.

Of course the thing that Tim Walberg and his Republican colleagues won't tell you is the costs for removing regulations. While government regulations may cost jobs and more money for tax payers, they don't cost lives. The gulf oil spill and the West Virginia mining accidents were due in part to a lack of a proper regulatory system. It should also be noted that the removal of regulations was a major contributor to the housing bubble that led to the most recent economic downturn, costing around 8 million jobs.

It would also be a mistake to focus solely on the costs of regulations without acknowledging the benefits. By continuing to reduce regulations we run the risk of serious public health issues like the Chinese toothpaste that was tainted with poison. By in large government regulations follow the government mandate of being "for the public good". Just because a regulation has detractors doesn't mean that it should be repealed.

The other point I would like to make is that in a recent survey of 250 economists who work in corporate America, 80% of the economists termed the currently regulatory environment as "good". The other 20% was split between "bad" and "unsure". If regulations are such a burden on corporate America shouldn't they be aware of this? It is tough to say that corporate America is being held back by government regulations when less than 20% of corporate America agrees with that statement.

In some sense I really wish Tim Walberg would admit that he has an agenda since then at least he could show he stands for something. By claiming to be impartial and then voting with Republicans 93% of the time while only sponsoring two pieces of legislation Tim Walberg has proven he is just a good solider, not a valued leader. In this political climate we need leaders with ideas otherwise rhetoric like jobs are number one come of sounding like number two.

Friday, August 19, 2011

German Economic

Over the past week my colleagues have been debating austerity measures and in particular the austerity measures of Germany. The basic assumption seems to be that Germany is a success story so we should emulate their methods if we hope to have similar success.

If you look at Germany's economic policies over the past couple years you will see that austerity was part of their solution but to suggest that their subsequent economic success proves or disproves the effects of austerity is an oversimplification.

In addition to cutting back on government spending Germany has taken a number of other steps to promote economic success, one of which Libby mentioned in a previous post, which kept people at work with the government picking up the tab for some of the lost wages. Germany is also looking at tax cuts but only for the low and middle class workers. In addition they passed two different stimulus packages which involved infrastructure spending as well as their version of cash for clunkers. They are also increasing revenue by adding taxes to different segments of the economy.

One other thing that should be noted is that in the New York Times article, quoted in this debate, the writer seems to give credit to an increase in the Germany retirement age for their economic success. That is fine except that the increase in the German retirement age has not occurred yet. It is scheduled to be phased in starting 2012 and fully integrated in 2029. I think it is a stretch to claim the future increase in retirement age as rational for the current recovery.

To the extent that Germany is an economic success story it has achieved this using a balanced approach. If only some American politicians would fight for a balanced approach so we could mimic the success of Germany.

If you look at Germany's economic policies over the past couple years you will see that austerity was part of their solution but to suggest that their subsequent economic success proves or disproves the effects of austerity is an oversimplification.

In addition to cutting back on government spending Germany has taken a number of other steps to promote economic success, one of which Libby mentioned in a previous post, which kept people at work with the government picking up the tab for some of the lost wages. Germany is also looking at tax cuts but only for the low and middle class workers. In addition they passed two different stimulus packages which involved infrastructure spending as well as their version of cash for clunkers. They are also increasing revenue by adding taxes to different segments of the economy.

One other thing that should be noted is that in the New York Times article, quoted in this debate, the writer seems to give credit to an increase in the Germany retirement age for their economic success. That is fine except that the increase in the German retirement age has not occurred yet. It is scheduled to be phased in starting 2012 and fully integrated in 2029. I think it is a stretch to claim the future increase in retirement age as rational for the current recovery.

To the extent that Germany is an economic success story it has achieved this using a balanced approach. If only some American politicians would fight for a balanced approach so we could mimic the success of Germany.

Tuesday, August 16, 2011

BS Watch Update: Amy K. Nelson

In what was one of the most trafficked posts in the history of the Furriners blog, on March 2nd, I called out Amy K. Nelson for saying on Jim Rome Is Burning that the New York Yankees had "no shot" at the postseason.

Well, we are at the 3/4 poll here on August 16th. Let's review the standings:

On winning percentage, the best team in baseball is the Philadelphia Phillies (.655).

The best team in the American League is the Boston Red Sox (.617).

The New York Yankees, whom Ms. Nelson claimed had "no shot" at the playoffs, have the third best record (.613). They are a 1/2 game behind the Red Sox in the A.L. East. Perhaps more relevant is if you look at the Wild Card Standings (which will actually determine if they make the playoffs), the Yankees have a 9.5 game lead over their nearest competitor!!! In other words, it would take a Jason Dufner-esque collapse for the Yankees to NOT make the playoffs.

Nice call, Amy!!

(I told you so)

Well, we are at the 3/4 poll here on August 16th. Let's review the standings:

On winning percentage, the best team in baseball is the Philadelphia Phillies (.655).

The best team in the American League is the Boston Red Sox (.617).

The New York Yankees, whom Ms. Nelson claimed had "no shot" at the playoffs, have the third best record (.613). They are a 1/2 game behind the Red Sox in the A.L. East. Perhaps more relevant is if you look at the Wild Card Standings (which will actually determine if they make the playoffs), the Yankees have a 9.5 game lead over their nearest competitor!!! In other words, it would take a Jason Dufner-esque collapse for the Yankees to NOT make the playoffs.

Nice call, Amy!!

(I told you so)

Texas taxes

Now that Governor Rick Perry has thrown his hat into the Republican Presidential candidate ring there is certain to be a lot of talk about an odd phenomenon over the last few years where Texas has created as many as 50% (depending on what report you read) of the new jobs since the start of the Bush recession.

While there are a number of explanations for this "Texas Miracle" the only one that I have really heard people latch onto is the corporate tax rates in Texas.

If the dogma surrounding taxes is that less is better then Texas can not be your star pupil. According to the Tax Foundation Texas ranks 13th in the nation for corporate tax climates. If you believe the lower taxes explain job creation, as Rick Perry supporters would have you believe, then Texas should at least be in the top 3 if not number one.

Even if you do use a source that puts Texas near the top of the tax climate ladder, such as the Small Business & Entrepreneur Council, and compare that with the recent Gallup job creation index you will see there is no correlation between job creation and corporate tax rates. The same is true of corporate tax rates and unemployment.