Since the elections this past November I have been sending a letter to Representative Tim Walberg once a week asking him the same question each time. That question pertains to the statement on the Walberg for Congress website in the section titled “Tim Walberg’s plan to create jobs” where he says he wants to “eliminate the capital gains tax”. What I wanted to understand is how eliminating the Capital Gains Tax would create jobs and what benefits eliminating the Capital Gains Tax would create beyond that.

According the Wikipedia a Capital Gains tax (CGT) is a tax on “the profit realized on the sale of a non-inventory asset that was purchased at a lower price. The most common capital gains are realized from the sale of stocks, bonds, precious metals and property”. The item that I am most interested in is the Stock Market since the dogma of the Stock Market is that everyone can participate and get rich. My research however indicates that the Stock Market is a tool that the rich use to rapidly increase their wealth while giving the illusion of equal opportunity. Unfortunately Tim Walberg’s proposal would only further exasperate this issue.

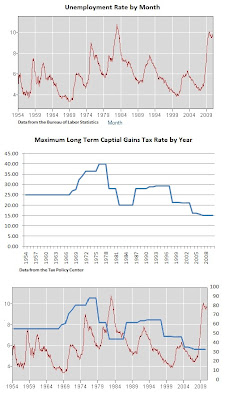

In his eventual response to my letter Representative Walberg stated “It is my opinion that eliminating or reducing the capital gains tax would help increase economic growth”. The attached graph shows no correlation between unemployment and the Capital Gains tax rate. Additionally, reports by the Tax Policy Center and the Advanced Market Intelligence for Advisors show no correlation between the CGT rate and the growth rates of GDP or the Stock Market. Given the lack of a clear cause and effect the claim that cutting the Capital Gains tax rate will improve the economy appears to be more opinion than fact.

It should also be noted that from 2001-2004, when Capital Gains tax rates were at the lowest numbers if over half a century, was the first time in history that we saw a drop in participation in the stock market. This would indicate that there is also little correlation between the Capital Gains tax rate and participation in the Stock Market.

Perhaps the claim has to do with a belief that lowering taxes in general helps the economy. Again the data would not back Representative Walberg’s stance. The Tax Policy Center shows that the top 3% of tax return paid 83% of the Capital Gains tax. This means that the other 17% is paid by the remaining 97% of Americans. This clearly indicates that it is the super rich who get the benefit from the Stock Market. And a CBO report on the Bush tax cuts for the top 2% shows that economic growth from those tax cuts will result in an increase in jobs of between 0.0% and 0.1%. If the vast majority of the benefit of a cut in the CGT rate goes to the super rich and tax cuts for the rich have almost no affect on the economy then it follows that cutting the CGT rate will not lead to an increase in the economy.

Also in his response Representative Walberg stated “It is estimated that 83 million Americans invest in the stock market and the average investor is in their 40s, employed and earns about $60,000”. While his statistics may be true it is also true that the top 10% hold almost 80% of all stocks.

Maybe Representative Walberg feels that eliminated the CGT will help the poor who participate in the Stock Market. According to a Federal Reserve report only about half of American households own stocks and fewer than 30% hold stocks outside of a retirement account. For the 20% or so that hold stocks in a retirement account CGT does not apply. Regardless of the CGT rate, any contributions to a 401K are free from CGT. You will have to pay income tax when you pull the money out but not CGT. Additionally, tax payers with ordinary income tax rates of 15% or less already pay a CGT of 0.0%. This means eliminating the CGT, as Mr. Walberg would like to do, will result in no change to the “average” investor that Mr. Walberg implies will be helped by his policy change.

The reality is that thanks to the already historically low CGT rates the super rich shift their earnings to the Stock Market to avoid paying taxes. An IRS report shows that the top 400 individual tax payers only made 6.5% of their wealth through salaries and wages while bringing home 81.3% of their money in the form of Capital Gains. A good example of how this is done can be seen right here in Michigan. This past year Bill Ford Jr. received $16 million in compensation - $4 million in salary and $12 million in stock options. By taking stock options he can reduce his tax burden by up to 2.4 million dollars. Worse yet is Oracle CEO Larry Ellison who was paid a base salary of $5 million in $980 million in exercised stock options. Unfortunately very few Americans are offered stock options in lieu of wages, so this is an opportunity that is only available to a select few.

Defenders of cuts to the CGT will suggest that investing in the stock market is a risky and you can lose money. While this is true it is also true that the government will subsidize your losses. Imagine if you lost $50 gambling and as you were leaving the Casino handed you a $10 bill. This is essentially what our current tax system does. The only people who don’t get their money back when their stock tanks are those in retirement accounts, since you can’t claim the loss in a retirement account on your tax return.

I am certainly in support of anything that will create jobs but cutting the CGT rate is a blatant give away to the rich disguised as an opportunity for everyone.

Derek Jeter Hater replies:

ReplyDeleteFine post... though it makes two consecutive posts in which you've misspelled "subsidize"!