In a recent post regarding the stimulus a number of commentors referenced the Obama administrations claim that the stimulus would keep unemployment under 8% as proof that the stimulus was a failure.

First it should be noted that President Obama never "promised" that unemployment would remain under 8%. That was a projection which turned out to be incorrect but whether this prediction was correct or incorrect has no bearing on the overall effectiveness of the stimulus.

For example in 2000 President Bush predicted that the economy would see an additional 3.4 million jobs and a budget deficit of $14 billion dollars by 2003. These projections were partly based on the 2001 tax cuts championed by George W. Bush. The actually tally was a loss of 1.7 million jobs and a $521 billion budget deficit.

Does that mean that the tax cuts failed simply because he failed to meet his projections? No. To determine the actual cause of the job losses and increase in budget deficit you would need a thorough analysis of all of the data not some amateur examination of anecdotal evidence.

Not surprisingly both men took the same tact when addressing these failures by blaming outside forces yet to many conservatives when these justifications came from George W. Bush they were rational examples of how projecting economic data is a tricky business while when they come from Barack Obama they are just excuses for his failed policies.

The reality is projecting the future of the economy is an extraordinarily difficult endeavor and no policy is ever judged before it has a chance to be fully executed. Hindsight has given us plenty of time to review both of these policies and at no point in any study regarding the overall effectiveness of either piece of legislation are educated guesses preceding their implementation considered.

If we weren't so informed we might be Republicans. Or Matt Leinart fans.

Wednesday, August 15, 2012

Thursday, August 9, 2012

Rehasing the stimulus debate

This presidential election cycle has turned into a sound bite debate. We no longer discuss actual solutions and policy but instead play on people's prejudices with exaggerations and misrepresentations of slanted rhetoric.

One example of this is Mitt Romney’s efforts to deflect attention from his tax plan that runs counter to the preferences of the American people and raises taxes on the middle class and poor while simultaneously lowering taxes for the rich. The Romney camp has decided rather than defend their plan, they would attack the presidents record - more specifically the stimulus package. Mitt Romney's basic take is that the stimulus failed and he references a "number of empirical studies" as proof.

One big problem for Romney is that some of the authors of the studies he references suggest that the Romney camp is misinterpreting their studies. Another problem for Romney is that fact that the two largest provisions and over a third of the total cost of the stimulus were tax cuts. So if the stimulus failed as Romney claims then it seems that tax cuts are not as stimulative as conservatives like to think yet tax cuts are the basis for Romney's economic recovery plan.

But perhaps the biggest problem for Romney is the fact that there are considerably more empirical studies that show that the stimulus worked. And the paper that Romney is really hanging his hat on was authored by these men:

Kevin Hassett - Senior Fellow at the conservative think tank AEI, Chief economic advisor to John McCain in 2000, and economic advisor to George W. Bush in 2004 and John McCain again in 2008.

John Taylor - Under Secretary of the Treasury for International Affairs and member of the President's Council of Economic Advisors for George W. Bush.

Greg Mankiw - Chairman of the Council of Economic Advisers for George W. Bush and current economic advisor to Mitt Romney.

Glenn Hubbard - Visiting scholar at AEI, Chairman of the Council of Economic Advisors under President George W. Bush, and economic advisor to Mitt Romney for both his 2008 and 2012 presidential campaigns.

If bias is a reason to distrust information then people should be skeptical of this report given that all of the authors are clearly supporting Mitt Romney and have a vested interest in making sure Barack Obama and his policies look bad.

The good news for Mitt Romney is that bias doesn't inherently prove that a study and its conclusions are inaccurate. Having said that, the American people should be suspicious of a politician that uses a study authored by members of his own staff combined with misrepresentations of other studies, to prove that his conclusions are facts.

One example of this is Mitt Romney’s efforts to deflect attention from his tax plan that runs counter to the preferences of the American people and raises taxes on the middle class and poor while simultaneously lowering taxes for the rich. The Romney camp has decided rather than defend their plan, they would attack the presidents record - more specifically the stimulus package. Mitt Romney's basic take is that the stimulus failed and he references a "number of empirical studies" as proof.

One big problem for Romney is that some of the authors of the studies he references suggest that the Romney camp is misinterpreting their studies. Another problem for Romney is that fact that the two largest provisions and over a third of the total cost of the stimulus were tax cuts. So if the stimulus failed as Romney claims then it seems that tax cuts are not as stimulative as conservatives like to think yet tax cuts are the basis for Romney's economic recovery plan.

But perhaps the biggest problem for Romney is the fact that there are considerably more empirical studies that show that the stimulus worked. And the paper that Romney is really hanging his hat on was authored by these men:

Kevin Hassett - Senior Fellow at the conservative think tank AEI, Chief economic advisor to John McCain in 2000, and economic advisor to George W. Bush in 2004 and John McCain again in 2008.

John Taylor - Under Secretary of the Treasury for International Affairs and member of the President's Council of Economic Advisors for George W. Bush.

Greg Mankiw - Chairman of the Council of Economic Advisers for George W. Bush and current economic advisor to Mitt Romney.

Glenn Hubbard - Visiting scholar at AEI, Chairman of the Council of Economic Advisors under President George W. Bush, and economic advisor to Mitt Romney for both his 2008 and 2012 presidential campaigns.

If bias is a reason to distrust information then people should be skeptical of this report given that all of the authors are clearly supporting Mitt Romney and have a vested interest in making sure Barack Obama and his policies look bad.

The good news for Mitt Romney is that bias doesn't inherently prove that a study and its conclusions are inaccurate. Having said that, the American people should be suspicious of a politician that uses a study authored by members of his own staff combined with misrepresentations of other studies, to prove that his conclusions are facts.

Friday, August 3, 2012

I challenge Stephen Colbert to a children's book-off

There is a long history of politicians and their families penning books for children. This list includes Presidents like Teddy Roosevelt, Jimmy Carter, and Barack Obama as well as family members like Laura and Jenna Bush, Meghan McCain, and Callista Gingrich. But the book in this genre I am most interested in is the book authored by well known conservative newsman Stephen Colbert titled "I Am a Pole (And So Can You)" which tells the story a poll looking for its true calling in life.

With this in mind I decided to write my own book as a response to Stephen's Colbert's attempt at children's literature.

If I can tool, anyone can.

I am a tool I just don’t know what kind

I must be important in more than my mind

Perhaps I’m a tool for a sly sneaky Fox

The kind with great hair that just talks, talks, talks, talks

Or maybe I’m a tool for a giant corporation

Convincing the world their greed’s good for the nation

Maybe I’m a tool for a big Papa Bear

With a temper, a big mouth and a nice comfy chair

How about a tool for more military might

Outspending the world but still it’s too light

Clearly I’m a tool that fits any program

But I’d still like to know the type of tool that I am

I could be a tool for the top one percent

To make sure everyone thanks them for the money they’ve spent

It’s possible I’m a tool for a gun organization

Warning people about the impending gun confiscation

It’s conceivable that I’m a tool for a rogue Elephant

To give her a hand remembering things that she can’t

Or perhaps I’m a tool for a pretty tea party

To help take back this country from the truly foolhardy

But I’ve finally realized everyone uses me

And I think I discovered what tool I must be

It’s clear that so far I’ve have been thinking too small

I’m a misinformed voter – the biggest tool of all

With this in mind I decided to write my own book as a response to Stephen's Colbert's attempt at children's literature.

If I can tool, anyone can.

I am a tool I just don’t know what kind

I must be important in more than my mind

Perhaps I’m a tool for a sly sneaky Fox

The kind with great hair that just talks, talks, talks, talks

Or maybe I’m a tool for a giant corporation

Convincing the world their greed’s good for the nation

Maybe I’m a tool for a big Papa Bear

With a temper, a big mouth and a nice comfy chair

How about a tool for more military might

Outspending the world but still it’s too light

Clearly I’m a tool that fits any program

But I’d still like to know the type of tool that I am

I could be a tool for the top one percent

To make sure everyone thanks them for the money they’ve spent

It’s possible I’m a tool for a gun organization

Warning people about the impending gun confiscation

It’s conceivable that I’m a tool for a rogue Elephant

To give her a hand remembering things that she can’t

Or perhaps I’m a tool for a pretty tea party

To help take back this country from the truly foolhardy

But I’ve finally realized everyone uses me

And I think I discovered what tool I must be

It’s clear that so far I’ve have been thinking too small

I’m a misinformed voter – the biggest tool of all

Thursday, August 2, 2012

The double standard of crime

When we talk about reducing crime there is a belief that the laws we have in place act as a deterrent to would be criminals. This article from the Heritage Foundation talks in some depth about the idea.

If this idea is true for individuals it should also be true for companies which are just a collection of individuals. Yet many of those who want more and stricter laws for individuals are many of the same people who argue against adding any regulations to industry.

The standard argument against this is that regulations cost jobs. While this may be true it is also true that not having regulations can cost jobs and sometimes lives. The BP oil spill, for example, was caused by corporations cutting corners and ignoring regulations and it cost lives, jobs, and economic activity.

As a result the BP CEO in charge when these decisions occurred spent zero days in jail and paid no fine but he did receive an $18 million dollar severance package - not much a deterrent for other CEO's contemplating a similar avoidance of rules and regulations.

Similarly the excessive risks taken by the banking industry cost millions a jobs when the housing bubble burst. A bubble which was seen by many well before it occurred yet nothing was done to avoid this crisis and no one was held accountable for the actions that resulted in the great recession.

If more and stricter laws work to prevent crimes then it should be used to prevent all crimes. As Supreme Court Justice John Marshall Harlan stated "But in view of the constitution, in the eye of the law, there is in this country no superior, dominant, ruling class of citizens...all citizens are equal before the law."

Holding one segment to a different moral standard than the rest is un-American and unjust no matter the rationalization.

If this idea is true for individuals it should also be true for companies which are just a collection of individuals. Yet many of those who want more and stricter laws for individuals are many of the same people who argue against adding any regulations to industry.

The standard argument against this is that regulations cost jobs. While this may be true it is also true that not having regulations can cost jobs and sometimes lives. The BP oil spill, for example, was caused by corporations cutting corners and ignoring regulations and it cost lives, jobs, and economic activity.

As a result the BP CEO in charge when these decisions occurred spent zero days in jail and paid no fine but he did receive an $18 million dollar severance package - not much a deterrent for other CEO's contemplating a similar avoidance of rules and regulations.

Similarly the excessive risks taken by the banking industry cost millions a jobs when the housing bubble burst. A bubble which was seen by many well before it occurred yet nothing was done to avoid this crisis and no one was held accountable for the actions that resulted in the great recession.

If more and stricter laws work to prevent crimes then it should be used to prevent all crimes. As Supreme Court Justice John Marshall Harlan stated "But in view of the constitution, in the eye of the law, there is in this country no superior, dominant, ruling class of citizens...all citizens are equal before the law."

Holding one segment to a different moral standard than the rest is un-American and unjust no matter the rationalization.

Wednesday, July 25, 2012

Bachmann investigation

Michele Bachmann recently called for and investigation into some members of the government she suspects of having ties to the Muslim Brotherhood.

While this sort of McCarthyism is always welcome here in America I think there is another investigation involving Michele Bachmann that should take precedent.

That investigation is regarding Michele Bachmann's secret agenda to promote the gay lifestyle.

It is a well known fact that Michele Bachmann's husband, Marcus, is a homosexual. After all, some of the most trusted talking heads have implied as much and if there is one thing that I have learned from watching Fox News it's that when a talking head says something it must be true.

Some will point to Marcus Bachmann's faith based clinic aimed at removing the gay from homosexuals as proof that he is not gay but common sense tells us this is a ruse. For example when the president expanded gun rights, no one was fooled. Everyone knows he is really secretly planning a full scale attack on the 2nd amendment at 5:00 am November 7th.

Similarly the only reason someone would be so adamant about curing gay is to cover the fact that they are secretly gay and plotting a gay revolution. Additionally this gives Marcus access to more homosexuals allowing him to more easily spread his secret gay agenda.

Another obvious sign of this covert operation are the 23 foster kids that the Bachmann's have helped raise. Given their wealth they weren't taking in foster kids for the money so the only possible explanation is that they want to indoctrinate as many children as possible with the pro-gay message. This allowed them unfettered access to a number of kids that they could keep quarantined until they were certain that the indoctrination was complete.

This also explains Michele Bachmann's penchant for publicly supporting so many fringe ideas. These are clearly meant as diversionary tactics to keep people for suspecting the Bachmann's of any radical agenda but as well respected journalist Nancy Grace says “When you’re pointing a finger at someone, you have four fingers pointed back at you.” To my knowledge Michele Bachmann has never come out and said she isn't planning a gay takeover. If she isn't then why wouldn't she just say so?

So while I applaud Michele Bachmann's efforts to end the obvious infestation of Muslim spies in our government who are attempting to spread Sharia law. I am adamantly against her clandestine plot to overthrow the government with a gay army. We true patriots need to take back to country from homosexual zealots like the Bachmann's and keep gay where it belongs - in the closet.

While this sort of McCarthyism is always welcome here in America I think there is another investigation involving Michele Bachmann that should take precedent.

That investigation is regarding Michele Bachmann's secret agenda to promote the gay lifestyle.

It is a well known fact that Michele Bachmann's husband, Marcus, is a homosexual. After all, some of the most trusted talking heads have implied as much and if there is one thing that I have learned from watching Fox News it's that when a talking head says something it must be true.

Some will point to Marcus Bachmann's faith based clinic aimed at removing the gay from homosexuals as proof that he is not gay but common sense tells us this is a ruse. For example when the president expanded gun rights, no one was fooled. Everyone knows he is really secretly planning a full scale attack on the 2nd amendment at 5:00 am November 7th.

Similarly the only reason someone would be so adamant about curing gay is to cover the fact that they are secretly gay and plotting a gay revolution. Additionally this gives Marcus access to more homosexuals allowing him to more easily spread his secret gay agenda.

Another obvious sign of this covert operation are the 23 foster kids that the Bachmann's have helped raise. Given their wealth they weren't taking in foster kids for the money so the only possible explanation is that they want to indoctrinate as many children as possible with the pro-gay message. This allowed them unfettered access to a number of kids that they could keep quarantined until they were certain that the indoctrination was complete.

This also explains Michele Bachmann's penchant for publicly supporting so many fringe ideas. These are clearly meant as diversionary tactics to keep people for suspecting the Bachmann's of any radical agenda but as well respected journalist Nancy Grace says “When you’re pointing a finger at someone, you have four fingers pointed back at you.” To my knowledge Michele Bachmann has never come out and said she isn't planning a gay takeover. If she isn't then why wouldn't she just say so?

So while I applaud Michele Bachmann's efforts to end the obvious infestation of Muslim spies in our government who are attempting to spread Sharia law. I am adamantly against her clandestine plot to overthrow the government with a gay army. We true patriots need to take back to country from homosexual zealots like the Bachmann's and keep gay where it belongs - in the closet.

Wednesday, July 18, 2012

The Capital Gains Tax rate fallacy revisited.

Last week I posted an article about capital gains taxes which elicited a number of comments. The argument made most often was the idea that capital gains taxes should not be increased because capital gains is a double tax.

There are a number of issues with this belief that I wanted to discuss. The first and most basic issue is with the idea that the money you use to invest in the stock market has already been taxed and therefore is double taxed when you sell the stock. The problem with this belief is that your original investment is not subject to capital gains tax. Only the gain is subject to the tax. For example if you invest $1,000 and a year later you sell the stock for $1,500 only the additional $500 is subject to any capital gains tax.

The second and considerably more complex idea of how capital gains is a double tax is based on the idea that corporations already pay a rate of 35% on their income so when you as the investor pay your 15% you are actually paying an additional second tax.

One of the biggest problems with this line of thinking is the fact that around 69% of corporations paid no federal income tax and according to the Wall Street Journal the average corporate tax rate is 12.1% of profits not 35%. Obviously if the company paid no taxes then it would be difficult to claim double taxation.

Additionally this argument relies on the idea that stockholders bear 100% of the burden of this imaginary 35%. Analysis on the topic suggests this tax burden is instead shared by workers, consumers and shareholders. Lowering the shareholders tax burden even further.

It should be noted that capital gains is derived from many sources many of which this argument is not applicable for. As an example Mitt Romney had $13 million in carried interest which is taxed as capital gains even though it is really just commission and has not been taxed at any other point.

The same is true of stocks. For an investor to earn money in the stock market the companies they invest in do not have to make a profit. Stock prices often increase on the perception of future profit rather than actual profit. As I mentioned previously High Frequency trading accounts for around 70% of the stock market volume and these investors manage to make small profits every minute completely unrelated to the companies performance over the past few minutes.

So is it possible that you as and investor are being double taxed on your investment? Yes. But even when that is the case the double taxed rate is typically lower than the rate you would pay if you had earned this money in the form of wages.

But the best proof that the capital gains tax is an advantage over other ways of earning money is the fact that the richest Americans earned 81.3% of their income from capital gains, dividends and interest while only 6.5% of their income came from salaries and wages.

There are a number of issues with this belief that I wanted to discuss. The first and most basic issue is with the idea that the money you use to invest in the stock market has already been taxed and therefore is double taxed when you sell the stock. The problem with this belief is that your original investment is not subject to capital gains tax. Only the gain is subject to the tax. For example if you invest $1,000 and a year later you sell the stock for $1,500 only the additional $500 is subject to any capital gains tax.

The second and considerably more complex idea of how capital gains is a double tax is based on the idea that corporations already pay a rate of 35% on their income so when you as the investor pay your 15% you are actually paying an additional second tax.

One of the biggest problems with this line of thinking is the fact that around 69% of corporations paid no federal income tax and according to the Wall Street Journal the average corporate tax rate is 12.1% of profits not 35%. Obviously if the company paid no taxes then it would be difficult to claim double taxation.

Additionally this argument relies on the idea that stockholders bear 100% of the burden of this imaginary 35%. Analysis on the topic suggests this tax burden is instead shared by workers, consumers and shareholders. Lowering the shareholders tax burden even further.

It should be noted that capital gains is derived from many sources many of which this argument is not applicable for. As an example Mitt Romney had $13 million in carried interest which is taxed as capital gains even though it is really just commission and has not been taxed at any other point.

The same is true of stocks. For an investor to earn money in the stock market the companies they invest in do not have to make a profit. Stock prices often increase on the perception of future profit rather than actual profit. As I mentioned previously High Frequency trading accounts for around 70% of the stock market volume and these investors manage to make small profits every minute completely unrelated to the companies performance over the past few minutes.

So is it possible that you as and investor are being double taxed on your investment? Yes. But even when that is the case the double taxed rate is typically lower than the rate you would pay if you had earned this money in the form of wages.

But the best proof that the capital gains tax is an advantage over other ways of earning money is the fact that the richest Americans earned 81.3% of their income from capital gains, dividends and interest while only 6.5% of their income came from salaries and wages.

Tuesday, July 17, 2012

The value of a helmet

There has been some discussion over the past few weeks on this blog on the value of helmet laws. Part of me thinks that mandating helmets is a good thing because it saves lives. Having said that I certainly understand the desire to choose to wear a helmet or not.

With that in mind I wanted to share an example of how you walk away from a motorcycle accident with a headache instead of being carted away in a body bag.

Look twice and drive safe.

With that in mind I wanted to share an example of how you walk away from a motorcycle accident with a headache instead of being carted away in a body bag.

Look twice and drive safe.

Friday, July 13, 2012

The Capital Gains Tax rate fallacy

One of the biggest fallacies generated by the rich and perpetuated by conservatives is the idea that the Capital Gains Tax (CGT) rate is an important component of a healthy economy.

The reality is that study after study finds no correlation between the CGT and economic growth or unemployment.

One of the biggest questions surrounding the CGT rate is why money earned for investing in the stock market should be subject to a different tax rate than money earned for actually working and receiving a pay check. This is a clear example of the government picking the winners and losers. Those who can make the bulk of their money in stocks are the winners and those who have to punch a clock for a living are the losers. Nowhere is this more evident than the IRS report showing the richest 400 Americans earned 81.3% of their income from Capital Gains, dividends and interest while only earning 6.5% from salaries and wages.

It should also be noted that the only time a company ever receives any money from the sale of stocks is in the initial public offering. Every trade after that is no different than selling a used car. The money goes to the seller not the manufacturer.

That is not to say there is no value in the stock market. Clearly if you are an investor your goal is to buy low and sell high and you need other buyers to consummate those transactions. But acting like eliminating this tax loophole will suddenly halt all capital investments ignores reality.

For example the short term CGT receives no special treatment from the IRS and is taxed at the same rate as other income. Today the fastest growing method a stock trading is something known as High Frequency trading where computers make thousands of trades every second. It is estimated that High Frequency trading now accounts for around 70% of the total trade volume.

This buying and selling of stocks within minutes is all taxed at the higher short term CGT rate. If the meme of CGT rates affecting investment were true, we would see a massive shift towards long term holding but the complete opposite is true.

The reason for this is the return on investment. Even if you pay 35% on all of your profits there is no easier way to get such a high rate of return. As an added plus even if your investment goes bad the Government subsidizes your losses with a tax break.

Even Ronald Reagan realized the issue with the CGT loophole when he stumped for his tax reform act of 1986 which raised the CGT rate to the same as other income.

"We’re going to close the unproductive tax loopholes that allow some of the truly wealthy to avoid paying their fair share. In theory, some of those loopholes were understandable, but in practice they sometimes made it possible for millionaires to pay nothing, while a bus driver was paying ten percent of his salary, and that’s crazy. [...] Do you think the millionaire ought to pay more in taxes than the bus driver or less?"

Of course words of wisdom from an iconic conservative and data showing that lowering the CGT rate has no affect on economic activity does nothing to dissuade Republicans from believing in this fallacy. Their blind faith actually has them clamoring for a complete elimination of the CGT. This should come as no surprise since over 90% of stocks, bonds and mutual funds are held by the top 10% who are generous with both their opinions and money around election time each year.

In the end if Republicans are hell bent on defending these robber barons with gratuitous tax loopholes and characterizing them as "job creation" then it should come as no surprise when Democrats respond with the Robin Hood like redistribution of wealth tactics in an attempt to level the playing field - the political equivalent of an eye for an eye.

The reality is that study after study finds no correlation between the CGT and economic growth or unemployment.

One of the biggest questions surrounding the CGT rate is why money earned for investing in the stock market should be subject to a different tax rate than money earned for actually working and receiving a pay check. This is a clear example of the government picking the winners and losers. Those who can make the bulk of their money in stocks are the winners and those who have to punch a clock for a living are the losers. Nowhere is this more evident than the IRS report showing the richest 400 Americans earned 81.3% of their income from Capital Gains, dividends and interest while only earning 6.5% from salaries and wages.

It should also be noted that the only time a company ever receives any money from the sale of stocks is in the initial public offering. Every trade after that is no different than selling a used car. The money goes to the seller not the manufacturer.

That is not to say there is no value in the stock market. Clearly if you are an investor your goal is to buy low and sell high and you need other buyers to consummate those transactions. But acting like eliminating this tax loophole will suddenly halt all capital investments ignores reality.

For example the short term CGT receives no special treatment from the IRS and is taxed at the same rate as other income. Today the fastest growing method a stock trading is something known as High Frequency trading where computers make thousands of trades every second. It is estimated that High Frequency trading now accounts for around 70% of the total trade volume.

This buying and selling of stocks within minutes is all taxed at the higher short term CGT rate. If the meme of CGT rates affecting investment were true, we would see a massive shift towards long term holding but the complete opposite is true.

The reason for this is the return on investment. Even if you pay 35% on all of your profits there is no easier way to get such a high rate of return. As an added plus even if your investment goes bad the Government subsidizes your losses with a tax break.

Even Ronald Reagan realized the issue with the CGT loophole when he stumped for his tax reform act of 1986 which raised the CGT rate to the same as other income.

"We’re going to close the unproductive tax loopholes that allow some of the truly wealthy to avoid paying their fair share. In theory, some of those loopholes were understandable, but in practice they sometimes made it possible for millionaires to pay nothing, while a bus driver was paying ten percent of his salary, and that’s crazy. [...] Do you think the millionaire ought to pay more in taxes than the bus driver or less?"

Of course words of wisdom from an iconic conservative and data showing that lowering the CGT rate has no affect on economic activity does nothing to dissuade Republicans from believing in this fallacy. Their blind faith actually has them clamoring for a complete elimination of the CGT. This should come as no surprise since over 90% of stocks, bonds and mutual funds are held by the top 10% who are generous with both their opinions and money around election time each year.

In the end if Republicans are hell bent on defending these robber barons with gratuitous tax loopholes and characterizing them as "job creation" then it should come as no surprise when Democrats respond with the Robin Hood like redistribution of wealth tactics in an attempt to level the playing field - the political equivalent of an eye for an eye.

Wednesday, July 11, 2012

Talking points for the upcoming tax debate

In an attempt to get out in front of the conservative talking point machine the president has again stated his desire to retain much of the Bush era tax cuts with the exception of income above $250,000.

There is a tendency for people to believe that under this proposal you will suddenly see a massive increase in your taxes once you hit $250,001 but the reality is that with our tax system your first $250,000 is taxed at the same rate regardless of how much you make beyond that and only the additional $1 would be subject to a higher tax rate. This is not a massive tax increase.

Another thing to consider with this proposal is that the debate and subsequent stalemate sure to follow will kill job growth. If you look back at the debt ceiling debate from last year you will see that jobs were increasing at a steady pace until the Republicans added in the uncertainty of expanding the debt ceiling which killed job growth for the duration of the debate. Once settled, jobs returned to their pre-debt ceiling debate levels and the unemployment rate dropped.

But the one thing I find really funny about the tax increase debate is the inconsistency with which it is argued. If you listen to conservatives they lament that something like 47% of tax payers paid no federal income tax. They will also claim that the top 1% pays around 36% of the taxes while only earning 17% of the income.

While both of these statistics are true, they are taken from different points in tax code. To prove that 47% of tax payers pay no Federal taxes you have to go to the point in the tax code after everyone has taken out their deductions and exemptions and determined their "Taxable Income" (Line 43 of Form 1040).

However to prove that the rich pay 36% of the taxes while only earning 17% of the income you have to use "Adjusted Gross Income" which comes from line 38 of Form 1040.

If you calculate both of these numbers at "Taxable Income" you still get 47% of tax payers paying no Federal income tax however it also changes the percentages for the Top 1%. Instead of earning 17% and paying 36% they earn 31% of the income while only paying 22% of the taxes.

If instead you decide that the important data is the "Adjusted Gross Income" then the Top 1% pays more than their fair share of taxes but that basically eliminates the 47% of tax payers that pay no Federal income tax.

The reason that understanding the difference between how these two talking points are figured is important is because they require different competing solutions. Essentially fixing one of these two issues will have a detrimental effect on the other. Broaden the base to include more tax payers and the percentage the Top 1% pays goes up, while cutting taxes will increase the number of people not paying taxes.

Getting people to believe that these are two sides to the same coin is a win win for Republicans since any attempts to fix either perceived problem will make the other look worse which of course will lead to louder cries for how unfair the system is.

Understanding the origin of these numbers is important to understanding how politicians and talking heads are intentionally or unintentionally manipulating the populous. Because an educated electorate is a politicians worst enemy.

There is a tendency for people to believe that under this proposal you will suddenly see a massive increase in your taxes once you hit $250,001 but the reality is that with our tax system your first $250,000 is taxed at the same rate regardless of how much you make beyond that and only the additional $1 would be subject to a higher tax rate. This is not a massive tax increase.

Another thing to consider with this proposal is that the debate and subsequent stalemate sure to follow will kill job growth. If you look back at the debt ceiling debate from last year you will see that jobs were increasing at a steady pace until the Republicans added in the uncertainty of expanding the debt ceiling which killed job growth for the duration of the debate. Once settled, jobs returned to their pre-debt ceiling debate levels and the unemployment rate dropped.

But the one thing I find really funny about the tax increase debate is the inconsistency with which it is argued. If you listen to conservatives they lament that something like 47% of tax payers paid no federal income tax. They will also claim that the top 1% pays around 36% of the taxes while only earning 17% of the income.

While both of these statistics are true, they are taken from different points in tax code. To prove that 47% of tax payers pay no Federal taxes you have to go to the point in the tax code after everyone has taken out their deductions and exemptions and determined their "Taxable Income" (Line 43 of Form 1040).

However to prove that the rich pay 36% of the taxes while only earning 17% of the income you have to use "Adjusted Gross Income" which comes from line 38 of Form 1040.

If you calculate both of these numbers at "Taxable Income" you still get 47% of tax payers paying no Federal income tax however it also changes the percentages for the Top 1%. Instead of earning 17% and paying 36% they earn 31% of the income while only paying 22% of the taxes.

If instead you decide that the important data is the "Adjusted Gross Income" then the Top 1% pays more than their fair share of taxes but that basically eliminates the 47% of tax payers that pay no Federal income tax.

The reason that understanding the difference between how these two talking points are figured is important is because they require different competing solutions. Essentially fixing one of these two issues will have a detrimental effect on the other. Broaden the base to include more tax payers and the percentage the Top 1% pays goes up, while cutting taxes will increase the number of people not paying taxes.

Getting people to believe that these are two sides to the same coin is a win win for Republicans since any attempts to fix either perceived problem will make the other look worse which of course will lead to louder cries for how unfair the system is.

Understanding the origin of these numbers is important to understanding how politicians and talking heads are intentionally or unintentionally manipulating the populous. Because an educated electorate is a politicians worst enemy.

Thursday, July 5, 2012

When lying is justified

Last week the Supreme Court made a decision that angered a lot of people. They stuck down the Stolen Valor Act which made it illegal for a person to lie about their military record.

The Supreme Court ruled that falsely claiming to have won a particular military honor was an act of free speech and therefore the Stolen Valor Act was unconstitutional.

While on the surface this seems like a disappointing ruling it should be noted that anyone who lies and profits from those lies can still be prosecuted for fraud. Essentially our system is already set up to handle those who benefit from lies while also protecting a person's right to make up stories even when those stories are offensive to some.

Congress seems determined to take up the cause again and attempt to refine the law to make it pass constitutional muster. Which I think is great but I find it ironic that Congress is attempting to make lying illegal.

After all who lies more than a politician? They lie so often that an entire industry has popped up to fact check these prevaricators.

Making matters worse is that their lies actually have an effect on public opinion. Take for example the Affordable Care Act. When asked about the individual parts of the bill, many components have broad support but when asked about the bill overall the support goes down. This disconnect can be attributed to lies like death panels and coverage for illegal immigrants.

So if you are an elected official who is tasked with the job of helping run the country and in an attempt to defund the institution you say that abortion services are well over 90% of what Planned Parenthood does while in reality the number is closer to 3%, you can just slough it off by saying that the lie that you spoke on the floor of the Senate was never meant to be a factual statement. But if you lie about having earned a purple heart to impress your high school classmates, Congress thinks you should pay a fine and spend some time in prison.

Is lying about your military record reprehensible? Yup. Is it worse than lying to sway public opinion on public policy? Probably not. But these are the results you get when the good of the country becomes a distant second to the good of the party.

The Supreme Court ruled that falsely claiming to have won a particular military honor was an act of free speech and therefore the Stolen Valor Act was unconstitutional.

While on the surface this seems like a disappointing ruling it should be noted that anyone who lies and profits from those lies can still be prosecuted for fraud. Essentially our system is already set up to handle those who benefit from lies while also protecting a person's right to make up stories even when those stories are offensive to some.

Congress seems determined to take up the cause again and attempt to refine the law to make it pass constitutional muster. Which I think is great but I find it ironic that Congress is attempting to make lying illegal.

After all who lies more than a politician? They lie so often that an entire industry has popped up to fact check these prevaricators.

Making matters worse is that their lies actually have an effect on public opinion. Take for example the Affordable Care Act. When asked about the individual parts of the bill, many components have broad support but when asked about the bill overall the support goes down. This disconnect can be attributed to lies like death panels and coverage for illegal immigrants.

So if you are an elected official who is tasked with the job of helping run the country and in an attempt to defund the institution you say that abortion services are well over 90% of what Planned Parenthood does while in reality the number is closer to 3%, you can just slough it off by saying that the lie that you spoke on the floor of the Senate was never meant to be a factual statement. But if you lie about having earned a purple heart to impress your high school classmates, Congress thinks you should pay a fine and spend some time in prison.

Is lying about your military record reprehensible? Yup. Is it worse than lying to sway public opinion on public policy? Probably not. But these are the results you get when the good of the country becomes a distant second to the good of the party.

Friday, June 29, 2012

Tax or penalty?

With the decision by the Supreme Court regarding the Affordable Care Act (affectionately known as Obamacare) we are seeing posturing from both sides on how to frame the debate moving forward. The White House is sticking to the term "penalty" to describe the tax assessed to those who don't buy health care insurance while those on the right such as Tommy De Seno on Fox News suggest that there is no precedence for a tax without an exchange of money.

The reality is that our tax code is filled with penalties similar to the one the Supreme Court just ruled constitutional. If you aren't married you pay a tax penalty, if you don't have kids you pay a tax penalty, if you don't own the home that you live in you pay a tax penalty, if you earn your income in the form of wages instead of capital gains you pay a tax penalty.

So regardless what you want to call it this ruling doesn't establish some completely new Marxist taxing tool, it just uses the tax code to promote certain behaviors. Is this the job of the government? Maybe. Maybe not. But if the government telling you what to do is the problem with the health care tax penalty then it is also a problem with the other penalties that we currently enjoy which help some and hurt others.

The reality is that our tax code is filled with penalties similar to the one the Supreme Court just ruled constitutional. If you aren't married you pay a tax penalty, if you don't have kids you pay a tax penalty, if you don't own the home that you live in you pay a tax penalty, if you earn your income in the form of wages instead of capital gains you pay a tax penalty.

So regardless what you want to call it this ruling doesn't establish some completely new Marxist taxing tool, it just uses the tax code to promote certain behaviors. Is this the job of the government? Maybe. Maybe not. But if the government telling you what to do is the problem with the health care tax penalty then it is also a problem with the other penalties that we currently enjoy which help some and hurt others.

Thursday, June 28, 2012

Legislating personal freedom

Over the weekend my colleague Mako Yamakura put together a post regarding his thoughts on the new motorcycle helmet law enacted recently in Michigan. This article generated a number of good comments with some support for Mako's stance that requiring helmets for motorcycle riders is one of the good types of regulations that saves lives while others feel that the choice to wear a helmet is a personal freedom.

While I’m not really concerned about the new law the reality is that the people who support it under the cover of personal freedom are complete hypocrites.

If these people truly believed in the personal freedoms of all American's they wouldn't legislate what collection of cells it is OK for a doctor to remove, they wouldn't legislate who a person is allowed to marry, they wouldn't legislate a person's ability to pay for sex, they wouldn't legislate a person's choice to end their own life, they wouldn't legislate who has to carry identification papers, they wouldn't legislate what drugs a person is allow to consume, and they wouldn't censure a legislator for expressing her first amendment right to say the word vagina.

The truth is that all American’s believe in personal freedom and it is embarrassingly simplistic logic to term every regulation you oppose as an attack on personal freedom while simultaneously supporting the suppression of other’s personal freedoms simply because of your moral objections.

Either you support personal freedom or you don’t but picking and choosing based on your personal biases means you don’t.

Wednesday, June 27, 2012

Personal freedom

Over the weekend my colleague Mako Yamakura put together a post regarding his thoughts on the new motorcycle helmet law enacted recently in Michigan. This article generated a number of good comments with some support for Mako's stance that requiring helmets for motorcycle riders is one of the good types of regulations that saves lives while others feel that the choice to wear a helmet is a personal freedom.

While I'm not really concerned about the new law I find the rhetoric of those who support it to be particularly fallacious.

When they use the term personal freedom what they really mean is the freedom to do the things they like and legislate and suppress the things they are against.

If these people truly believed in the personal freedoms of all American's they wouldn't legislate what collection of cells it is OK for a doctor to remove, they wouldn't legislate who a person is allowed to marry, they wouldn't legislate a person's ability to pay for sex, they wouldn't legislate a person's choice to end their own life, they wouldn't legislate who has to carry identification papers, they wouldn't legislate what drugs a person is allow to consume, and they wouldn't censure a legislator for expressing her first amendment right to say the word vagina.

So if you want to ride helmetless on your hog, swigging a 32 oz Slurpee, yelling out curse words, while smoking a cigarette, with a semi-automatic firearm strapped to your back on your way to a rally against polio vaccines you won't get an argument from me. But realize that your attempts to legislate my morals is just more job killing tax increasing big government overreach that infringes on my personal freedoms, which, of course, makes you a complete hypocrite.

While I'm not really concerned about the new law I find the rhetoric of those who support it to be particularly fallacious.

When they use the term personal freedom what they really mean is the freedom to do the things they like and legislate and suppress the things they are against.

If these people truly believed in the personal freedoms of all American's they wouldn't legislate what collection of cells it is OK for a doctor to remove, they wouldn't legislate who a person is allowed to marry, they wouldn't legislate a person's ability to pay for sex, they wouldn't legislate a person's choice to end their own life, they wouldn't legislate who has to carry identification papers, they wouldn't legislate what drugs a person is allow to consume, and they wouldn't censure a legislator for expressing her first amendment right to say the word vagina.

So if you want to ride helmetless on your hog, swigging a 32 oz Slurpee, yelling out curse words, while smoking a cigarette, with a semi-automatic firearm strapped to your back on your way to a rally against polio vaccines you won't get an argument from me. But realize that your attempts to legislate my morals is just more job killing tax increasing big government overreach that infringes on my personal freedoms, which, of course, makes you a complete hypocrite.

Thursday, June 14, 2012

Michigan Republicans need to abort their attacks on women rights

When the debate over health care was focused on the Affordable Care Act (affectionately known as Obamacare or Romneycare) Republican Senator John Barrasso said “I don’t want anybody between a doctor and a patient" and Republican Representative John Boehner said we need to "stop excessive regulations".

Well apparently Michigan Republican's didn't get the memo because the restrictions on abortion rights they are currently entertaining are both excessive regulations and another example of politicians putting themselves squarely between a doctor and their patient.

The bill they have been discussing puts new regulations on abortion clinics and makes having an abortion after 20 weeks a crime even in case of rape or incest and even when a doctor recommends an abortion for the safety of the mother.

Roe vs. Wade makes the right to have an abortion as much of a constitutional right as the right to bear arms yet for some reason any attempt to limit gun rights is framed as infringing on personal freedom and on one's right to defend themselves. So to these people having an abortion to save your life is murder but shooting someone who you believe poses a threat is not only justifiable but warranted.

If these people truly valued human life they would use their power and the litany of research that exists on the topic to help prevent unwanted pregnancies from happening in the first place like what Planned Parenthood does. Instead Republicans have set as their top priorities cutting education spending, social welfare programs, and access to health care for the poor - all of which negatively affect the teen pregnancy rates - and then have the audacity to whine about the consequences their own misguided policies have caused.

It is time that our politicians took a little personal responsibility for the consequences of their actions instead of always blaming someone else for the problems they create.

Well apparently Michigan Republican's didn't get the memo because the restrictions on abortion rights they are currently entertaining are both excessive regulations and another example of politicians putting themselves squarely between a doctor and their patient.

The bill they have been discussing puts new regulations on abortion clinics and makes having an abortion after 20 weeks a crime even in case of rape or incest and even when a doctor recommends an abortion for the safety of the mother.

Roe vs. Wade makes the right to have an abortion as much of a constitutional right as the right to bear arms yet for some reason any attempt to limit gun rights is framed as infringing on personal freedom and on one's right to defend themselves. So to these people having an abortion to save your life is murder but shooting someone who you believe poses a threat is not only justifiable but warranted.

If these people truly valued human life they would use their power and the litany of research that exists on the topic to help prevent unwanted pregnancies from happening in the first place like what Planned Parenthood does. Instead Republicans have set as their top priorities cutting education spending, social welfare programs, and access to health care for the poor - all of which negatively affect the teen pregnancy rates - and then have the audacity to whine about the consequences their own misguided policies have caused.

It is time that our politicians took a little personal responsibility for the consequences of their actions instead of always blaming someone else for the problems they create.

Tuesday, June 12, 2012

The Finnish model of improving education

The recent Scott Walker win in Wisconsin has led to a lot a talk about how to successfully improve the American education system. Clearly the two parties have different solutions for fixing education but determining what makes a successful education system could be key to cutting through the partisan rhetoric and finding real answers. By most measures Finland has one of if not the best education systems in the world while also managing to achieve this success at a lower cost than most. So what makes Finland so successful?

There is no merit pay for teachers in Finland.

Students in Finland rarely have homework or take exams until they are in their teens.

There are no private schools in Finland.

There is only one mandatory standardized test administered at age 16.

Teachers are given the same status as Doctors and Lawyers

95% of teachers in Finland are unionized.

High school teachers in Finland make 102% of what other college graduates make compared to 62% for the US.

30 percent of children receive additional help in their first 9 years of school.

Unlike the US system the main driver of Finnish education policy has been the idea that every child should have exactly the same opportunity to learn, regardless of family background, income, or geographic location.

Teahcers only spend 4 hours per day in class and take 2 hours a week for professional development.

Finland has approximately the same number of teachers as New York City with nearly half the students.

Teachers have a great deal of educational control in choosing textbooks and customizing their lessons to meet national standards.

Elementary students get 75 minutes of recess per day versus an average of 27 in the US.

All of Finland's teachers must have a Master's Degree which is state subsidized.

The national curriculum is only broad outlines.

Teachers are selected from the top 10% of graduates.

Children are not measured at all in their first six years of education.

All children are taught in the same classroom.

What is most striking about this list is how completely opposite it is to current thinking in America. When Finland made changes to their education system their goal was to provide equality not excellence. As John F. Kennedy said "a rising tide lifts all boats" and the same appears to be true in Finland where providing equal opportunity for all, improves the results for everyone. While in the US President Obama has fallen in line with Republicans to push ideas like charter schools, merit pay, and standardized testing. So if you believe that education is getting worse, it’s getting worse as we move closer to a system of Republican ideas.

Essentially the US system represents the free market idea of education while the Finnish system represents the socialist plan for education and right now the socialists are winning.

There is no merit pay for teachers in Finland.

Students in Finland rarely have homework or take exams until they are in their teens.

There are no private schools in Finland.

There is only one mandatory standardized test administered at age 16.

Teachers are given the same status as Doctors and Lawyers

95% of teachers in Finland are unionized.

High school teachers in Finland make 102% of what other college graduates make compared to 62% for the US.

30 percent of children receive additional help in their first 9 years of school.

Unlike the US system the main driver of Finnish education policy has been the idea that every child should have exactly the same opportunity to learn, regardless of family background, income, or geographic location.

Teahcers only spend 4 hours per day in class and take 2 hours a week for professional development.

Finland has approximately the same number of teachers as New York City with nearly half the students.

Teachers have a great deal of educational control in choosing textbooks and customizing their lessons to meet national standards.

Elementary students get 75 minutes of recess per day versus an average of 27 in the US.

All of Finland's teachers must have a Master's Degree which is state subsidized.

The national curriculum is only broad outlines.

Teachers are selected from the top 10% of graduates.

Children are not measured at all in their first six years of education.

All children are taught in the same classroom.

What is most striking about this list is how completely opposite it is to current thinking in America. When Finland made changes to their education system their goal was to provide equality not excellence. As John F. Kennedy said "a rising tide lifts all boats" and the same appears to be true in Finland where providing equal opportunity for all, improves the results for everyone. While in the US President Obama has fallen in line with Republicans to push ideas like charter schools, merit pay, and standardized testing. So if you believe that education is getting worse, it’s getting worse as we move closer to a system of Republican ideas.

Essentially the US system represents the free market idea of education while the Finnish system represents the socialist plan for education and right now the socialists are winning.

Monday, June 11, 2012

Comment section house cleaning

One of the best parts of blogging for the Detroit News is the debate that often occurs after the article. Sometimes these conversations bring about good questions that deserve more than just a quick response in the comment section. For example in my recent post on Michelle Malkin I stated that "Republicans defend the wages of CEOs, because the more you pay, the better CEO you get." which prompted Tim Kelly to ask "Show us anyone that says that."

The Heritage Foundation November 16th, 2011:

"As frustrating as it may seem to watch top executives at government-backed firms take in millions in bonuses, in other words, the alternative is to limit those firms’ abilities to attract the best talent. The inevitable result is a crop of less-skilled managers, which put those companies at even greater risk of financial loss."

Cato Institute September 10, 2008:

"High executive compensation is a market outcome caused by limited supply and high and rising demand for top talent."

Glencore Chief Executive Ivan Glasenberg June 7th 2012:

"If you want good CEOs, you are going to have to pay."

Or these four talking heads on Fox News :

"If the shareholders want to get their money's worth, they better pay a good CEO what a good CEO demands."

Of course these are just individuals and organization who don't speak for all Republicans but it should be noted that in a survey of companies "over 40 percent of companies say that they want to pay their CEO's above market average -- numbers like 60 percent and 75 percent of market are often used."

Another good conversation was started in a post Libby had regarding Federal Spending where a few commenter’s took exception to the idea that George W. Bush would be responsible for the 2009 budget (excluding the 2009 stimulus spending).

The Cato Institute had this to say on the topic :

"critics sometimes blame Obama for things that are not his fault. Listening to a talk radio program yesterday, the host asserted that Obama tripled the budget deficit in his first year. This assertion is understandable, since the deficit jumped from about $450 billion in 2008 to $1.4 trillion in 2009. As this chart illustrates, with the Bush years in green, it appears as if Obama’s policies have led to an explosion of debt.

But there is one rather important detail that makes a big difference. The chart is based on the assumption that the current administration should be blamed for the 2009 fiscal year. While this makes sense to a casual observer, it is largely untrue. The 2009 fiscal year began October 1, 2008, nearly four months before Obama took office. The budget for the entire fiscal year was largely set in place while Bush was in the White House."

Also from this topic was the data that under Obama federal spending, after inflation, has actually decreased. Commenter Kevin Burke said "It is a fact that federal spending under Obama has skyrocketed. Just because you keep repeating a lie doesn't make it true."

Daniel J Mitchell of the Cato Institute did a more nuanced review of the numbers quoted in Libby's post and found that by certain measures "it turns out that Obama does win the prize for being the most fiscally conservative president in recent memory." After a few more tweaks Daniel eventually concludes that in terms of government spending Obama falls somewhere in the middle of the last eight presidents.

In the end I as a blogger always appreciate those of you who take the time to read these posts and comment and try my best to read and respond to as many of the good questions as I can. Hopefully these conversations help us to agree on some of the facts which should help us to respectfully disagree on our subsequent solutions.

The Heritage Foundation November 16th, 2011:

"As frustrating as it may seem to watch top executives at government-backed firms take in millions in bonuses, in other words, the alternative is to limit those firms’ abilities to attract the best talent. The inevitable result is a crop of less-skilled managers, which put those companies at even greater risk of financial loss."

Cato Institute September 10, 2008:

"High executive compensation is a market outcome caused by limited supply and high and rising demand for top talent."

Glencore Chief Executive Ivan Glasenberg June 7th 2012:

"If you want good CEOs, you are going to have to pay."

Or these four talking heads on Fox News :

"If the shareholders want to get their money's worth, they better pay a good CEO what a good CEO demands."

Of course these are just individuals and organization who don't speak for all Republicans but it should be noted that in a survey of companies "over 40 percent of companies say that they want to pay their CEO's above market average -- numbers like 60 percent and 75 percent of market are often used."

Another good conversation was started in a post Libby had regarding Federal Spending where a few commenter’s took exception to the idea that George W. Bush would be responsible for the 2009 budget (excluding the 2009 stimulus spending).

The Cato Institute had this to say on the topic :

"critics sometimes blame Obama for things that are not his fault. Listening to a talk radio program yesterday, the host asserted that Obama tripled the budget deficit in his first year. This assertion is understandable, since the deficit jumped from about $450 billion in 2008 to $1.4 trillion in 2009. As this chart illustrates, with the Bush years in green, it appears as if Obama’s policies have led to an explosion of debt.

But there is one rather important detail that makes a big difference. The chart is based on the assumption that the current administration should be blamed for the 2009 fiscal year. While this makes sense to a casual observer, it is largely untrue. The 2009 fiscal year began October 1, 2008, nearly four months before Obama took office. The budget for the entire fiscal year was largely set in place while Bush was in the White House."

Also from this topic was the data that under Obama federal spending, after inflation, has actually decreased. Commenter Kevin Burke said "It is a fact that federal spending under Obama has skyrocketed. Just because you keep repeating a lie doesn't make it true."

Daniel J Mitchell of the Cato Institute did a more nuanced review of the numbers quoted in Libby's post and found that by certain measures "it turns out that Obama does win the prize for being the most fiscally conservative president in recent memory." After a few more tweaks Daniel eventually concludes that in terms of government spending Obama falls somewhere in the middle of the last eight presidents.

In the end I as a blogger always appreciate those of you who take the time to read these posts and comment and try my best to read and respond to as many of the good questions as I can. Hopefully these conversations help us to agree on some of the facts which should help us to respectfully disagree on our subsequent solutions.

Wednesday, June 6, 2012

Michelle Malkin takes it down a notch

With the failure of the Scott Walker recall election, Michelle Malkin took the opportunity to voice her distain for the unions and in particular the teachers unions that organized the recall vote.

While she may have some good points they are difficult to weed out among the 7th grade level tone Mrs. Malkin takes with her piece. Apparently Michelle believes name calling is an effective form of debate.

Mixed in with her juvenile taunts are the occasional examples of how one teacher acted inappropriately meant to paint the entire profession with the same brush. But who doesn't love equating the actions of one individual to the intentions of everyone within that group.

She of course follows this up with some data on union spending for the recall which conveniently ignores the fact that Republicans and their supporters outspent Democrats by a 7 to 1 margin in the run up to this vote. If her point is that money in elections is a problem, I agree. But that wouldn't fit with her theme that teachers unions are a bunch of booger eating doody-heads.

I imagine that one of the big reasons for Mrs. Malkin's condescending tone is the fact that she doesn't understand what the unions are fighting for. Michelle seems to think that Scott Walker and state Republicans were simply "asking teachers to contribute more to their pension plans". The reality is that Walker never asked. Framing this government power grab as union obstinance is a massive mischaracterization of the union’s position.

But the cherry on top of her article is her final paragraph where she states that "the union bosses have made one thing clear as a playground whistle: It's not about the children. It's never about the children." While fighting for the right to collectively bargain may have little to do with the children, Michelle Malkin should recognize that fighting to end collective bargaining rights isn't about the children either. As a matter of fact the cost cutting measures that Malkin apparently supports will have a detrimental effect on the education that Wisconsin students receive.

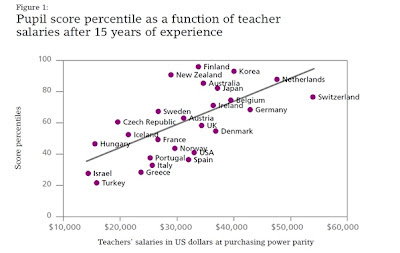

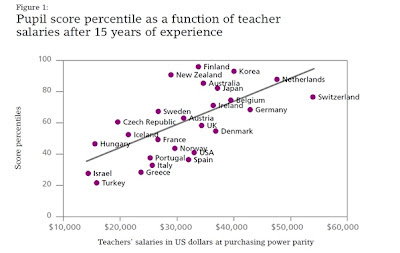

Michelle Malkin seems to prescribe to this Republican notion that we have a bunch of bad teachers and education will only improve when these awful teachers are removed. Yet it is also these same Republicans that defend that wages of CEO because the more you pay, the better CEO you get. I'm not sure where the disconnect comes in but a recent study shows that education is no different than other professions. The more you pay, the better the employee and the better the employee, the better the results.

If Republicans wanted to return to the glory days of the US they would see that a starting teacher made almost as much as first year lawyer while today the gap in pay is around $115,000. They might also be interested in knowing that there is a correlation with how much a country pays its teachers and the educational achievement of that country.

So while Michelle Malkin can take issue with the union bosses and the occasional radical teacher, acting like she and her party somehow have the best interests of students in mind as they systematically dismantle the collective bargaining rights of US union members shows how much of a bean pole poopy face she is.

While she may have some good points they are difficult to weed out among the 7th grade level tone Mrs. Malkin takes with her piece. Apparently Michelle believes name calling is an effective form of debate.

Mixed in with her juvenile taunts are the occasional examples of how one teacher acted inappropriately meant to paint the entire profession with the same brush. But who doesn't love equating the actions of one individual to the intentions of everyone within that group.

She of course follows this up with some data on union spending for the recall which conveniently ignores the fact that Republicans and their supporters outspent Democrats by a 7 to 1 margin in the run up to this vote. If her point is that money in elections is a problem, I agree. But that wouldn't fit with her theme that teachers unions are a bunch of booger eating doody-heads.

I imagine that one of the big reasons for Mrs. Malkin's condescending tone is the fact that she doesn't understand what the unions are fighting for. Michelle seems to think that Scott Walker and state Republicans were simply "asking teachers to contribute more to their pension plans". The reality is that Walker never asked. Framing this government power grab as union obstinance is a massive mischaracterization of the union’s position.

But the cherry on top of her article is her final paragraph where she states that "the union bosses have made one thing clear as a playground whistle: It's not about the children. It's never about the children." While fighting for the right to collectively bargain may have little to do with the children, Michelle Malkin should recognize that fighting to end collective bargaining rights isn't about the children either. As a matter of fact the cost cutting measures that Malkin apparently supports will have a detrimental effect on the education that Wisconsin students receive.

Michelle Malkin seems to prescribe to this Republican notion that we have a bunch of bad teachers and education will only improve when these awful teachers are removed. Yet it is also these same Republicans that defend that wages of CEO because the more you pay, the better CEO you get. I'm not sure where the disconnect comes in but a recent study shows that education is no different than other professions. The more you pay, the better the employee and the better the employee, the better the results.

If Republicans wanted to return to the glory days of the US they would see that a starting teacher made almost as much as first year lawyer while today the gap in pay is around $115,000. They might also be interested in knowing that there is a correlation with how much a country pays its teachers and the educational achievement of that country.

So while Michelle Malkin can take issue with the union bosses and the occasional radical teacher, acting like she and her party somehow have the best interests of students in mind as they systematically dismantle the collective bargaining rights of US union members shows how much of a bean pole poopy face she is.

Tuesday, June 5, 2012

Republicans have no business in government

Mitt Romney claims he is better for the country because of his business background. This is based on the conservative idea that government should be run like a business.

So the question then becomes how have companies successfully emerged from this recession? Ford is a good example given their size, debt issues and near collapse leading up to the great recession. Losing millions of dollars a year the company went deep into debt and cut costs by eliminating employees and shuttering unprofitable plants. This part of the Ford recovery plan is very similar to what the US government has done so far reducing government spending by an average of 1.4% per year under Obama after inflation and cutting government personnel by around 600,000 employees.

But that is where the similarities end. Unlike the federal government Ford has actually increased the cost of their products and reduced incentives boosting their profit by about $2,000 per car. Yes, running the government like a company requires that, as the economy improves, the costs of products and services increase or in terms of the federal government, taxes increase.

Suggesting a tax increase of course elicits cries from the right of already being overtaxed by the most radically socialist president this country has ever seen. Ignoring the ignorance of this claim it should be noted that according the Heritage Foundation we are currently near record lows when it comes to tax revenue and tax rates.

These same people also claim that any increase in tax rates will have a detrimental effect on the economy. Ford however seems to have experienced no such correlation as their increased prices have not produced a slowdown in sales. In fact sales are still increasing.

No businessman worth his salt would run his business like the Republicans are attempting to run the government. Even Mitt Romney raised an additional $750 in revenue from taxes in his time as governor. The reality is that these people don't want to run the government like a business. They want to run the government into the ground.

So the question then becomes how have companies successfully emerged from this recession? Ford is a good example given their size, debt issues and near collapse leading up to the great recession. Losing millions of dollars a year the company went deep into debt and cut costs by eliminating employees and shuttering unprofitable plants. This part of the Ford recovery plan is very similar to what the US government has done so far reducing government spending by an average of 1.4% per year under Obama after inflation and cutting government personnel by around 600,000 employees.

But that is where the similarities end. Unlike the federal government Ford has actually increased the cost of their products and reduced incentives boosting their profit by about $2,000 per car. Yes, running the government like a company requires that, as the economy improves, the costs of products and services increase or in terms of the federal government, taxes increase.

Suggesting a tax increase of course elicits cries from the right of already being overtaxed by the most radically socialist president this country has ever seen. Ignoring the ignorance of this claim it should be noted that according the Heritage Foundation we are currently near record lows when it comes to tax revenue and tax rates.

These same people also claim that any increase in tax rates will have a detrimental effect on the economy. Ford however seems to have experienced no such correlation as their increased prices have not produced a slowdown in sales. In fact sales are still increasing.

No businessman worth his salt would run his business like the Republicans are attempting to run the government. Even Mitt Romney raised an additional $750 in revenue from taxes in his time as governor. The reality is that these people don't want to run the government like a business. They want to run the government into the ground.

Friday, June 1, 2012

Barack Obama's economic policies are failing!

The May jobs report shows that our economy's slow growth is getting slower and Republicans are suggesting this proves the president’s economic policies are failing. I couldn't agree more.

The president has allowed corporate interests and Republicans to run roughshod over American economic policy and the affects have been slow growth. This includes the following:

A too small stimulus bill chock full of tax cuts.

Using corporate tax cuts as a method of economic stimulus.

"Company profits ... increased at an 11.7 percent annual rate from the previous quarter and were up 14.8 percent from a year ago."

Continuing of the Bush tax cuts.

"federal taxes as a share of gross domestic product were at their lowest level in generations."

Failure to get implement public option in health care reform.

"CBO estimates for liberals' preferred version of the public option that show $85 billion more in savings than for the version the Blue Dogs prefer."

Buying into the "Job Creators" argument which allows the rich like Mitt Romney to pay a tax rate lower than the average American.

"Millionaire entrepreneur and venture capitalist Nick Hanauer puts it this way: “An ordinary middle-class consumer is far more of a job creator than I ever have been or ever will be.”

Allowing states and the federal government to cut massive amounts of public sector jobs costing the country over a million jobs and reducing the GDP by 0.78 percentage point in the first quarter of 2012.

"Typically, the government offers a base level of support" when the economy is weak, says Scott Brown, chief economist at Raymond James & Associates. "In this case, the government is actually contributing to the weakness of the recovery.

Continuing two costly wars.